Rust-powered collection of financial functions.

PyXIRR stands for "Python XIRR" (for historical reasons), but contains many other financial functions such as IRR, FV, NPV, etc.

Features:

- correct

- supports different day count conventions (e.g. ACT/360, 30E/360, etc.)

- works with different input data types (iterators, numpy arrays, pandas DataFrames)

- no external dependencies

- type annotations

- blazingly fast

pip install pyxirr

WASM wheels for pyodide are also available, but unfortunately are not supported by PyPI. You can find them on the GitHub Releases page.

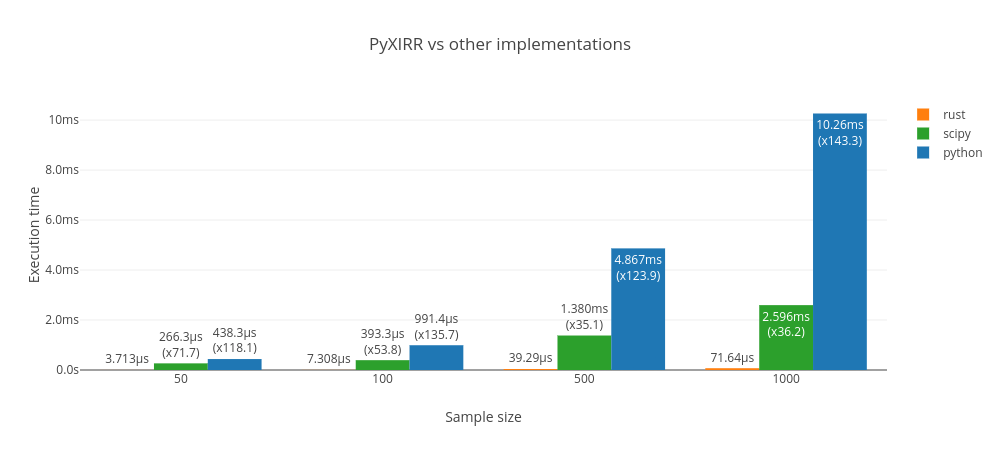

Rust implementation has been tested against existing xirr package (uses scipy.optimize under the hood) and the implementation from the Stack Overflow (pure python).

PyXIRR is much faster than the other implementations.

Powered by github-action-benchmark and plotly.js.

Live benchmarks are hosted on Github Pages.

from datetime import date

from pyxirr import xirr

dates = [date(2020, 1, 1), date(2021, 1, 1), date(2022, 1, 1)]

amounts = [-1000, 750, 500]

# feed columnar data

xirr(dates, amounts)

# feed iterators

xirr(iter(dates), (x / 2 for x in amounts))

# feed an iterable of tuples

xirr(zip(dates, amounts))

# feed a dictionary

xirr(dict(zip(dates, amounts)))

# dates as strings

xirr(['2020-01-01', '2021-01-01'], [-1000, 1200])The Multiple IRR problem occurs when the signs of cash flows change more than once. In this case, we say that the project has non-conventional cash flows. This leads to situation, where it can have more the one IRR or have no IRR at all.

PyXIRR addresses the Multiple IRR problem as follows:

- It looks for positive result around 0.1 (the same as Excel with the default guess=0.1).

- If it can't find a result, it uses several other attempts and selects the lowest IRR to be conservative.

Here is an example illustrating how to identify multiple IRRs:

import numpy as np

import pyxirr

# load cash flow:

cf = pd.read_csv("tests/samples/30-22.csv", names=["date", "amount"])

# check whether the cash flow is conventional:

print(pyxirr.is_conventional_cash_flow(cf["amount"])) # false

# build NPV profile:

# calculate 50 NPV values for different rates

rates = np.linspace(-0.5, 0.5, 50)

# any iterable, any rates, e.g.

# rates = [-0.5, -0.3, -0.1, 0.1, -0.6]

values = pyxirr.xnpv(rates, cf)

# print NPV profile:

# NPV changes sign two times:

# 1) between -0.316 and -0.295

# 2) between -0.03 and -0.01

print("NPV profile:")

for rate, value in zip(rates, values):

print(rate, value)

# plot NPV profile

import pandas as pd

series = pd.Series(values, index=rates)

pd.DataFrame(series[series > -1e6]).assign(zero=0).plot()

# find points where NPV function crosses zero

indexes = pyxirr.zero_crossing_points(values)

print("Zero crossing points:")

for idx in indexes:

print("between", rates[idx], "and", rates[idx+1])

# XIRR has two results:

# -0.31540826742734207

# -0.028668460065441048

for i, idx in enumerate(indexes, start=1):

rate = pyxirr.xirr(cf, guess=rates[idx])

npv = pyxirr.xnpv(rate, cf)

print(f"{i}) {rate}; XNPV = {npv}")import numpy as np

import pandas as pd

# feed numpy array

xirr(np.array([dates, amounts]))

xirr(np.array(dates), np.array(amounts))

# feed DataFrame (columns names doesn't matter; ordering matters)

xirr(pd.DataFrame({"a": dates, "b": amounts}))

# feed Series with DatetimeIndex

xirr(pd.Series(amounts, index=pd.to_datetime(dates)))

# bonus: apply xirr to a DataFrame with DatetimeIndex:

df = pd.DataFrame(

index=pd.date_range("2021", "2022", freq="MS", inclusive="left"),

data={

"one": [-100] + [20] * 11,

"two": [-80] + [19] * 11,

},

)

df.apply(xirr) # Series(index=["one", "two"], data=[5.09623547168478, 8.780801977141174])Check out the available options on the docs/day-count-conventions.

from pyxirr import DayCount

xirr(dates, amounts, day_count=DayCount.ACT_360)

# parse day count from string

xirr(dates, amounts, day_count="30E/360")from pyxirr import pe

pe.pme_plus([-20, 15, 0], index=[100, 115, 130], nav=20)

pe.direct_alpha([-20, 15, 0], index=[100, 115, 130], nav=20)import pyxirr

# Future Value

pyxirr.fv(0.05/12, 10*12, -100, -100)

# Net Present Value

pyxirr.npv(0, [-40_000, 5_000, 8_000, 12_000, 30_000])

# IRR

pyxirr.irr([-100, 39, 59, 55, 20])

# ... and more! Check out the docs.PyXIRR supports numpy-like vectorization.

If all input is scalar, returns a scalar float. If any input is array_like, returns values for each input element. If multiple inputs are array_like, performs broadcasting and returns values for each element.

import pyxirr

# feed list

pyxirr.fv([0.05/12, 0.06/12], 10*12, -100, -100)

pyxirr.fv([0.05/12, 0.06/12], [10*12, 9*12], [-100, -200], -100)

# feed numpy array

import numpy as np

rates = np.array([0.05, 0.06, 0.07])/12

pyxirr.fv(rates, 10*12, -100, -100)

# feed any iterable!

pyxirr.fv(

np.linspace(0.01, 0.2, 10),

(x + 1 for x in range(10)),

range(-100, -1100, -100),

tuple(range(-100, -200, -10))

)

# 2d, 3d, 4d, and more!

rates = [[[[[[0.01], [0.02]]]]]]

pyxirr.fv(rates, 10*12, -100, -100)See the docs

- Implement all functions from numpy-financial

- Improve docs, add more tests

- Type hints

- Vectorized versions of numpy-financial functions.

- Compile library for rust/javascript/python

Running tests with pyo3 is a bit tricky. In short, you need to compile your tests without extension-module feature to avoid linking errors.

See the following issues for the details: #341, #771.

If you are using pyenv, make sure you have the shared library installed (check for ${PYENV_ROOT}/versions/<version>/lib/libpython3.so file).

$ PYTHON_CONFIGURE_OPTS="--enable-shared" pyenv install <version>Install dev-requirements

$ pip install -r dev-requirements.txt$ maturin develop$ LD_LIBRARY_PATH=${PYENV_ROOT}/versions/3.10.8/lib cargo test$ pip install -r bench-requirements.txt

$ LD_LIBRARY_PATH=${PYENV_ROOT}/versions/3.10.8/lib cargo +nightly benchThis library uses maturin to build and distribute python wheels.

$ docker run --rm -v $(pwd):/io ghcr.io/pyo3/maturin build --release --manylinux 2010 --strip

$ maturin upload target/wheels/pyxirr-${version}*