diff --git a/.env.centrifuge_demo b/.env.centrifuge_demo

new file mode 100644

index 00000000..c09e3f8b

--- /dev/null

+++ b/.env.centrifuge_demo

@@ -0,0 +1,6 @@

+ADMIN=0x423420Ae467df6e90291fd0252c0A8a637C1e03f

+PRIVATE_KEY=8e3ec2b1affade3231c6a81c299988176e0343dd8ce9f0986d66ed13e0f178d9

+AXELAR_GATEWAY=0x6aF9C075d8C11b9A2CD66bbA801481b3c7A96488

+RPC_URL=https://fullnode.demo.k-f.dev

+CHAIN_ID=2031

+ETHERSCAN_KEY=RESKUIN5V7MS5DCB3TZM6NC249B4FBTRZW

diff --git a/.env.goerli b/.env.goerli

new file mode 100644

index 00000000..a92de5f9

--- /dev/null

+++ b/.env.goerli

@@ -0,0 +1,8 @@

+ADMIN=0x423420Ae467df6e90291fd0252c0A8a637C1e03f

+PRIVATE_KEY=8e3ec2b1affade3231c6a81c299988176e0343dd8ce9f0986d66ed13e0f178d9

+AXELAR_GATEWAY=0xe432150cce91c13a887f7D836923d5597adD8E31

+CENTRIFUGE_FORWARDER=0xe6091b3Cc04584EaDbeCA59f2FdD0D81606f410b

+RPC_URL=https://goerli.infura.io/v3/a4ba76cd4be643618572e7467a444e3a

+ETHERSCAN_KEY=RESKUIN5V7MS5DCB3TZM6NC249B4FBTRZW

+CHAIN_ID=5

+SETUP_TEST_DATA=true

diff --git a/.github/workflows/ci.yml b/.github/workflows/ci.yml

index b36a6b7b..cacc1de7 100644

--- a/.github/workflows/ci.yml

+++ b/.github/workflows/ci.yml

@@ -113,33 +113,33 @@ jobs:

coverage-files: ./lcov.info

minimum-coverage: 60 # Set coverage threshold.

- slither-analyze:

- runs-on: "ubuntu-latest"

- permissions:

- actions: "read"

- contents: "read"

- security-events: "write"

- steps:

- - name: "Check out the repo"

- uses: "actions/checkout@v3"

- with:

- submodules: "recursive"

-

- - name: "Run Slither analysis"

- uses: "crytic/slither-action@v0.3.0"

- id: "slither"

- with:

- fail-on: "none"

- sarif: "results.sarif"

- solc-version: "0.8.21"

- target: "src/"

-

- - name: Upload SARIF file

- uses: github/codeql-action/upload-sarif@v2

- with:

- sarif_file: ${{ steps.slither.outputs.sarif }}

+ # slither-analyze:

+ # runs-on: "ubuntu-latest"

+ # permissions:

+ # actions: "read"

+ # contents: "read"

+ # security-events: "write"

+ # steps:

+ # - name: "Check out the repo"

+ # uses: "actions/checkout@v3"

+ # with:

+ # submodules: "recursive"

+

+ # - name: "Run Slither analysis"

+ # uses: "crytic/slither-action@v0.3.0"

+ # id: "slither"

+ # with:

+ # fail-on: "none"

+ # sarif: "results.sarif"

+ # solc-version: "0.8.21"

+ # target: "src/"

+

+ # - name: Upload SARIF file

+ # uses: github/codeql-action/upload-sarif@v2

+ # with:

+ # sarif_file: ${{ steps.slither.outputs.sarif }}

- - name: "Add Slither summary"

- run: |

- echo "## Slither result" >> $GITHUB_STEP_SUMMARY

- echo "✅ Uploaded to GitHub code scanning" >> $GITHUB_STEP_SUMMARY

\ No newline at end of file

+ # - name: "Add Slither summary"

+ # run: |

+ # echo "## Slither result" >> $GITHUB_STEP_SUMMARY

+ # echo "✅ Uploaded to GitHub code scanning" >> $GITHUB_STEP_SUMMARY

\ No newline at end of file

diff --git a/README.md b/README.md

index 5a505436..4028c9be 100644

--- a/README.md

+++ b/README.md

@@ -10,7 +10,7 @@ Liquidity Pools enable seamless deployment of Centrifuge RWA pools on any EVM-co

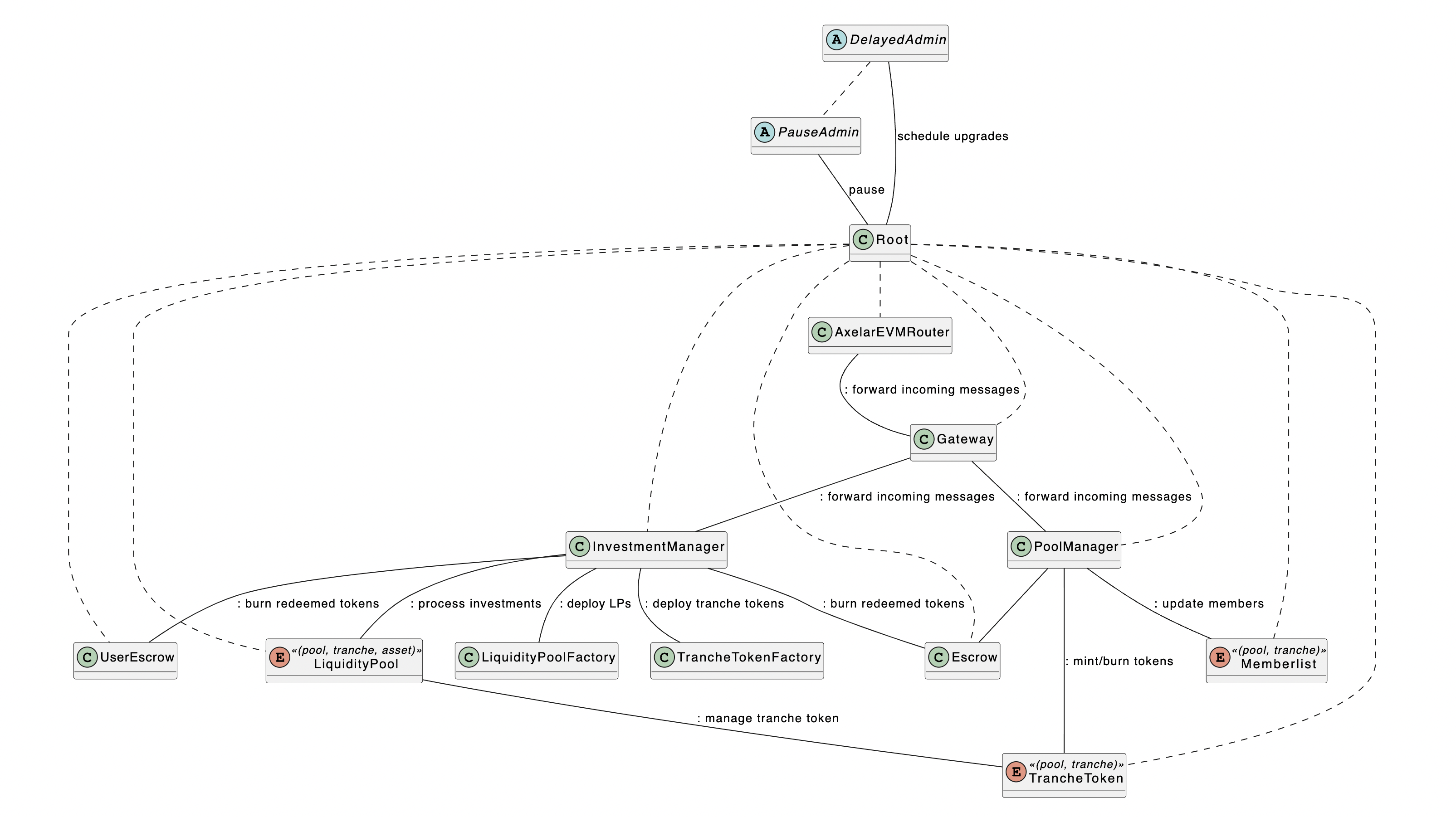

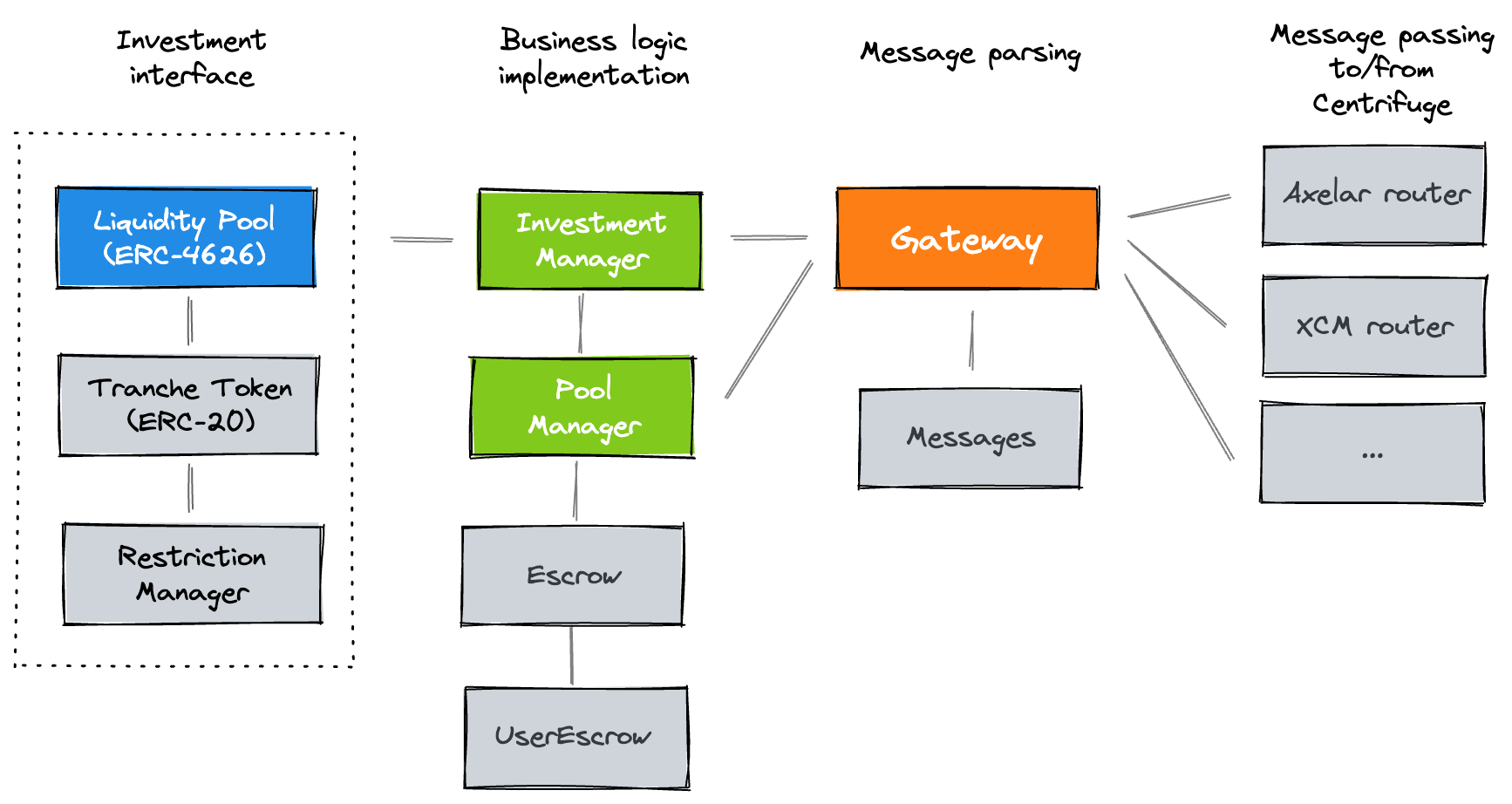

Investors can invest in multiple tranches for each RWA pool. Each of these tranches is a separate deployment of a Liquidity Pool and a Tranche Token.

-- [**Liquidity Pool**](https://github.com/centrifuge/liquidity-pools/blob/main/src/LiquidityPool.sol): A [ERC-4626](https://ethereum.org/en/developers/docs/standards/tokens/erc-4626/) compatible contract that enables investors to deposit and withdraw stablecoins to invest in tranches of pools.

+- [**Liquidity Pool**](https://github.com/centrifuge/liquidity-pools/blob/main/src/LiquidityPool.sol): An [ERC-7540](https://eips.ethereum.org/EIPS/eip-7540) (extension of [ERC-4626](https://ethereum.org/en/developers/docs/standards/tokens/erc-4626/)) compatible contract that enables investors to deposit and withdraw stablecoins to invest in tranches of pools.

- [**Tranche Token**](https://github.com/centrifuge/liquidity-pools/blob/main/src/token/Tranche.sol): An [ERC-20](https://ethereum.org/en/developers/docs/standards/tokens/erc-20/) token for the tranche, linked to a [`RestrictionManager`](https://github.com/centrifuge/liquidity-pools/blob/main/src/token/RestrictionManager.sol) that manages transfer restrictions. Prices for tranche tokens are computed on Centrifuge.

The deployment of these tranches and the management of investments is controlled by the underlying InvestmentManager, TokenManager, Gateway, and Routers.

@@ -33,5 +33,13 @@ To run all tests locally:

forge test

```

+## Audit reports

+

+| Auditor | Report link |

+|---|---|

+| Code4rena | [`September 2023 - Code4rena Report`](https://code4rena.com/reports/2023-09-centrifuge) |

+| SRLabs | [`September 2023 - SRLabs Report`](https://github.com/centrifuge/liquidity-pools/blob/main/audits/2023-09-SRLabs.pdf) |

+| Spearbit | [`October 2023 - Cantina Managed Report`](https://github.com/centrifuge/liquidity-pools/blob/main/audits/2023-10-Spearbit-Cantina-Managed.pdf) |

+

## License

-This codebase is licensed under [GNU Lesser General Public License v3.0](https://github.com/centrifuge/centrifuge-chain/blob/main/LICENSE).

+This codebase is licensed under [GNU Lesser General Public License v3.0](https://github.com/centrifuge/liquidity-pools/blob/main/LICENSE).

diff --git a/assets/architecture.svg b/assets/architecture.svg

index d04e3d7f..ab49d82a 100644

--- a/assets/architecture.svg

+++ b/assets/architecture.svg

@@ -44,7 +44,7 @@

-

+

diff --git a/audits/2023-09-Code4rena.md b/audits/2023-09-Code4rena.md

new file mode 100644

index 00000000..9e7dabe6

--- /dev/null

+++ b/audits/2023-09-Code4rena.md

@@ -0,0 +1,1630 @@

+# Overview

+

+## About C4

+

+Code4rena (C4) is an open organization consisting of security researchers, auditors, developers, and individuals with domain expertise in smart contracts.

+

+A C4 audit is an event in which community participants, referred to as Wardens, review, audit, or analyze smart contract logic in exchange for a bounty provided by sponsoring projects.

+

+During the audit outlined in this document, C4 conducted an analysis of the Centrifuge smart contract system written in Solidity. The audit took place between September 8—September 14 2023.

+

+## Wardens

+

+85 Wardens contributed reports to the Centrifuge:

+

+ 1. [ciphermarco](https://code4rena.com/@ciphermarco)

+ 2. [alexfilippov314](https://code4rena.com/@alexfilippov314)

+ 3. [0x3b](https://code4rena.com/@0x3b)

+ 4. [jaraxxus](https://code4rena.com/@jaraxxus)

+ 5. [twicek](https://code4rena.com/@twicek)

+ 6. [J4X](https://code4rena.com/@J4X)

+ 7. [0xStalin](https://code4rena.com/@0xStalin)

+ 8. [Aymen0909](https://code4rena.com/@Aymen0909)

+ 9. [bin2chen](https://code4rena.com/@bin2chen)

+ 10. [imtybik](https://code4rena.com/@imtybik)

+ 11. [castle\_chain](https://code4rena.com/@castle_chain)

+ 12. [HChang26](https://code4rena.com/@HChang26)

+ 13. [merlin](https://code4rena.com/@merlin)

+ 14. [maanas](https://code4rena.com/@maanas)

+ 15. [nobody2018](https://code4rena.com/@nobody2018)

+ 16. [0xnev](https://code4rena.com/@0xnev)

+ 17. [mert\_eren](https://code4rena.com/@mert_eren)

+ 18. [Bauchibred](https://code4rena.com/@Bauchibred)

+ 19. [josephdara](https://code4rena.com/@josephdara)

+ 20. BARW ([BenRai](https://code4rena.com/@BenRai) and [albertwh1te](https://code4rena.com/@albertwh1te))

+ 21. [ast3ros](https://code4rena.com/@ast3ros)

+ 22. [Ch\_301](https://code4rena.com/@Ch_301)

+ 23. [degensec](https://code4rena.com/@degensec)

+ 24. [0xpiken](https://code4rena.com/@0xpiken)

+ 25. [ravikiranweb3](https://code4rena.com/@ravikiranweb3)

+ 26. [lsaudit](https://code4rena.com/@lsaudit)

+ 27. [catellatech](https://code4rena.com/@catellatech)

+ 28. [Sathish9098](https://code4rena.com/@Sathish9098)

+ 29. [cats](https://code4rena.com/@cats)

+ 30. [kaveyjoe](https://code4rena.com/@kaveyjoe)

+ 31. [0xbrett8571](https://code4rena.com/@0xbrett8571)

+ 32. [0xfuje](https://code4rena.com/@0xfuje)

+ 33. [rvierdiiev](https://code4rena.com/@rvierdiiev)

+ 34. [0xmystery](https://code4rena.com/@0xmystery)

+ 35. [Kow](https://code4rena.com/@Kow)

+ 36. [0xRobsol](https://code4rena.com/@0xRobsol)

+ 37. [codegpt](https://code4rena.com/@codegpt)

+ 38. [0xkazim](https://code4rena.com/@0xkazim)

+ 39. [nmirchev8](https://code4rena.com/@nmirchev8)

+ 40. [gumgumzum](https://code4rena.com/@gumgumzum)

+ 41. [T1MOH](https://code4rena.com/@T1MOH)

+ 42. [Kral01](https://code4rena.com/@Kral01)

+ 43. [pipidu83](https://code4rena.com/@pipidu83)

+ 44. [Vagner](https://code4rena.com/@Vagner)

+ 45. [KrisApostolov](https://code4rena.com/@KrisApostolov)

+ 46. [0xTiwa](https://code4rena.com/@0xTiwa)

+ 47. [0xgrbr](https://code4rena.com/@0xgrbr)

+ 48. [PENGUN](https://code4rena.com/@PENGUN)

+ 49. [bitsurfer](https://code4rena.com/@bitsurfer)

+ 50. [ether\_sky](https://code4rena.com/@ether_sky)

+ 51. [0xklh](https://code4rena.com/@0xklh)

+ 52. [Phantasmagoria](https://code4rena.com/@Phantasmagoria)

+ 53. [ladboy233](https://code4rena.com/@ladboy233)

+ 54. [deth](https://code4rena.com/@deth)

+ 55. [IceBear](https://code4rena.com/@IceBear)

+ 56. [0xPacelli](https://code4rena.com/@0xPacelli)

+ 57. [MaslarovK](https://code4rena.com/@MaslarovK)

+ 58. [grearlake](https://code4rena.com/@grearlake)

+ 59. [rokinot](https://code4rena.com/@rokinot)

+ 60. [fouzantanveer](https://code4rena.com/@fouzantanveer)

+ 61. [K42](https://code4rena.com/@K42)

+ 62. [hals](https://code4rena.com/@hals)

+ 63. [emerald7017](https://code4rena.com/@emerald7017)

+ 64. [foxb868](https://code4rena.com/@foxb868)

+ 65. [0xLook](https://code4rena.com/@0xLook)

+ 66. [MohammedRizwan](https://code4rena.com/@MohammedRizwan)

+ 67. [jkoppel](https://code4rena.com/@jkoppel)

+ 68. [jolah1](https://code4rena.com/@jolah1)

+ 69. [alexzoid](https://code4rena.com/@alexzoid)

+ 70. [sandy](https://code4rena.com/@sandy)

+ 71. [btk](https://code4rena.com/@btk)

+ 72. [Kaysoft](https://code4rena.com/@Kaysoft)

+ 73. [klau5](https://code4rena.com/@klau5)

+ 74. [0xAadi](https://code4rena.com/@0xAadi)

+ 75. [Bughunter101](https://code4rena.com/@Bughunter101)

+ 76. [0xblackskull](https://code4rena.com/@0xblackskull)

+ 77. [SanketKogekar](https://code4rena.com/@SanketKogekar)

+ 78. [m\_Rassska](https://code4rena.com/@m_Rassska)

+ 79. [7ashraf](https://code4rena.com/@7ashraf)

+ 80. [JP\_Courses](https://code4rena.com/@JP_Courses)

+ 81. [Krace](https://code4rena.com/@Krace)

+ 82. [mrudenko](https://code4rena.com/@mrudenko)

+ 83. [fatherOfBlocks](https://code4rena.com/@fatherOfBlocks)

+ 84. [0xHelium](https://code4rena.com/@0xHelium)

+

+This audit was judged by [gzeon](https://code4rena.com/@gzeon).

+

+Final report assembled by [liveactionllama](https://twitter.com/liveactionllama).

+

+# Summary

+

+The C4 analysis yielded an aggregated total of 8 unique vulnerabilities. Of these vulnerabilities, 0 received a risk rating in the category of HIGH severity and 8 received a risk rating in the category of MEDIUM severity.

+

+Additionally, C4 analysis included 39 reports detailing issues with a risk rating of LOW severity or non-critical.

+

+All of the issues presented here are linked back to their original finding.

+

+# Scope

+

+The code under review can be found within the [C4 Centrifuge audit repository](https://github.com/code-423n4/2023-09-centrifuge), and is composed of 18 smart contracts written in the Solidity programming language and includes 2,657 lines of Solidity code.

+

+In addition to the known issues identified by the project team, a Code4rena bot race was conducted at the start of the audit. The winning bot, **IllIllI-bot** from warden IllIllI, generated the [Automated Findings report](https://github.com/code-423n4/2023-09-centrifuge/blob/main/bot-report.md) and all findings therein were classified as out of scope.

+

+# Severity Criteria

+

+C4 assesses the severity of disclosed vulnerabilities based on three primary risk categories: high, medium, and low/non-critical.

+

+High-level considerations for vulnerabilities span the following key areas when conducting assessments:

+

+- Malicious Input Handling

+- Escalation of privileges

+- Arithmetic

+- Gas use

+

+For more information regarding the severity criteria referenced throughout the submission review process, please refer to the documentation provided on [the C4 website](https://code4rena.com), specifically our section on [Severity Categorization](https://docs.code4rena.com/awarding/judging-criteria/severity-categorization).

+

+# Medium Risk Findings (8)

+## [[M-01] `onlyCentrifugeChainOrigin()` can't require `msg.sender` equal `axelarGateway`](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/537)

+*Submitted by [bin2chen](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/537), also found by [maanas](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/549), [nobody2018](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/442), [castle\_chain](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/290), [mert\_eren](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/289), and [merlin](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/212)*

+

+In `AxelarRouter.sol`, we need to ensure the legitimacy of the `execute()` method execution, mainly through two methods:

+

+1. `axelarGateway.validateContractCall ()` to validate if the `command` is approved or not.

+2. `onlyCentrifugeChainOrigin()` is used to validate that `sourceChain` `sourceAddress` is legal.

+

+Let's look at the implementation of `onlyCentrifugeChainOrigin()`:

+

+```solidity

+ modifier onlyCentrifugeChainOrigin(string calldata sourceChain, string calldata sourceAddress) {

+@> require(msg.sender == address(axelarGateway), "AxelarRouter/invalid-origin");

+ require(

+ keccak256(bytes(axelarCentrifugeChainId)) == keccak256(bytes(sourceChain)),

+ "AxelarRouter/invalid-source-chain"

+ );

+ require(

+ keccak256(bytes(axelarCentrifugeChainAddress)) == keccak256(bytes(sourceAddress)),

+ "AxelarRouter/invalid-source-address"

+ );

+ _;

+ }

+```

+

+The problem is that this restriction `msg.sender == address(axelarGateway)`.

+

+When we look at the official `axelarGateway.sol` contract, it doesn't provide any call external contract 's`execute()` method.

+

+So `msg.sender` cannot be `axelarGateway`, and the official example does not restrict `msg.sender`.

+

+The security of the command can be guaranteed by `axelarGateway.validateContractCall()`, `sourceChain`, `sourceAddress`.

+

+There is no need to restrict `msg.sender`.

+

+`axelarGateway` code address

+

+

+Can't find anything that calls `router.execute()`.

+

+### Impact

+

+`router.execute()` cannot be executed properly, resulting in commands from other chains not being executed, protocol not working properly.

+

+### Recommended Mitigation

+

+Remove `msg.sender` restriction

+

+```diff

+ modifier onlyCentrifugeChainOrigin(string calldata sourceChain, string calldata sourceAddress) {

+- require(msg.sender == address(axelarGateway), "AxelarRouter/invalid-origin");

+ require(

+ keccak256(bytes(axelarCentrifugeChainId)) == keccak256(bytes(sourceChain)),

+ "AxelarRouter/invalid-source-chain"

+ );

+ require(

+ keccak256(bytes(axelarCentrifugeChainAddress)) == keccak256(bytes(sourceAddress)),

+ "AxelarRouter/invalid-source-address"

+ );

+ _;

+ }

+```

+

+### Assessed type

+

+Context

+

+**[hieronx (Centrifuge) confirmed](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/537#issuecomment-1723464758)**

+

+**[gzeon (judge) increased severity to High and commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/537#issuecomment-1733894416):**

+ > This seems High risk to me since the Axelar bridge is a centerpiece of this protocol, and when deployed in a certain way where the AxelarRouter is the only ward, it might cause user deposits to be stuck forever.

+

+**[gzeon (judge) decreased severity to Medium and commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/537#issuecomment-1735848904):**

+ > Reconsidering severity to Medium here since the expected setup would have DelayedAdmin able to unstuck the system.

+

+**[hieronx (Centrifuge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/537#issuecomment-1745247688):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/168

+

+

+

+***

+

+## [[M-02] `LiquidityPool::requestRedeemWithPermit` transaction can be front run with the different liquidity pool](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/227)

+*Submitted by [alexfilippov314](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/227)*

+

+The permit signature is linked only to the tranche token. That's why it can be used with any liquidity pool with the same tranche token. Since anyone can call `LiquidityPool::requestRedeemWithPermit` the following scenario is possible:

+

+1. Let's assume that some user has some amount of tranche tokens. Let's also assume that there are multiple liquidity pools with the same tranche token. For example, USDX pool and USDY pool.

+2. The user wants to redeem USDX from the USDX pool using `requestRedeemWithPermit`. The user signs the permit and sends a transaction.

+3. A malicious actor can see this transaction in the mempool and use the signature from it to request a redemption from the USDY pool with a greater fee amount.

+4. Since this transaction has a greater fee amount it will likely be executed before the valid transaction.

+5. The user's transaction will be reverted since the permit has already been used.

+6. If the user will not cancel this malicious request until the end of the epoch this request will be executed, and the user will be forced to claim USDY instead of USDX.

+

+This scenario assumes some user's negligence and usually doesn't lead to a significant loss. But in some cases (for example, USDY depeg) a user can end up losing significantly.

+

+### Proof of Concept

+

+The test below illustrates the scenario described above:

+

+```solidity

+function testPOCIssue1(

+ uint64 poolId,

+ string memory tokenName,

+ string memory tokenSymbol,

+ bytes16 trancheId,

+ uint128 currencyId,

+ uint256 amount

+) public {

+ vm.assume(currencyId > 0);

+ vm.assume(amount < MAX_UINT128);

+ vm.assume(amount > 1);

+

+ // Use a wallet with a known private key so we can sign the permit message

+ address investor = vm.addr(0xABCD);

+ vm.prank(vm.addr(0xABCD));

+

+ LiquidityPool lPool =

+ LiquidityPool(deployLiquidityPool(poolId, erc20.decimals(), tokenName, tokenSymbol, trancheId, currencyId));

+ erc20.mint(investor, amount);

+ homePools.updateMember(poolId, trancheId, investor, type(uint64).max);

+

+ // Sign permit for depositing investment currency

+ (uint8 v, bytes32 r, bytes32 s) = vm.sign(

+ 0xABCD,

+ keccak256(

+ abi.encodePacked(

+ "\x19\x01",

+ erc20.DOMAIN_SEPARATOR(),

+ keccak256(

+ abi.encode(

+ erc20.PERMIT_TYPEHASH(), investor, address(investmentManager), amount, 0, block.timestamp

+ )

+ )

+ )

+ )

+ );

+

+ lPool.requestDepositWithPermit(amount, investor, block.timestamp, v, r, s);

+ // To avoid stack too deep errors

+ delete v;

+ delete r;

+ delete s;

+

+ // ensure funds are locked in escrow

+ assertEq(erc20.balanceOf(address(escrow)), amount);

+ assertEq(erc20.balanceOf(investor), 0);

+

+ // collect 50% of the tranche tokens

+ homePools.isExecutedCollectInvest(

+ poolId,

+ trancheId,

+ bytes32(bytes20(investor)),

+ poolManager.currencyAddressToId(address(erc20)),

+ uint128(amount),

+ uint128(amount)

+ );

+

+ uint256 maxMint = lPool.maxMint(investor);

+ lPool.mint(maxMint, investor);

+

+ {

+ TrancheToken trancheToken = TrancheToken(address(lPool.share()));

+ assertEq(trancheToken.balanceOf(address(investor)), maxMint);

+

+ // Sign permit for redeeming tranche tokens

+ (v, r, s) = vm.sign(

+ 0xABCD,

+ keccak256(

+ abi.encodePacked(

+ "\x19\x01",

+ trancheToken.DOMAIN_SEPARATOR(),

+ keccak256(

+ abi.encode(

+ trancheToken.PERMIT_TYPEHASH(),

+ investor,

+ address(investmentManager),

+ maxMint,

+ 0,

+ block.timestamp

+ )

+ )

+ )

+ )

+ );

+ }

+

+ // Let's assume that there is another liquidity pool with the same poolId and trancheId

+ // but a different currency

+ LiquidityPool newLPool;

+ {

+ assert(currencyId != 123);

+ address newErc20 = address(_newErc20("Y's Dollar", "USDY", 6));

+ homePools.addCurrency(123, newErc20);

+ homePools.allowPoolCurrency(poolId, 123);

+ newLPool = LiquidityPool(poolManager.deployLiquidityPool(poolId, trancheId, newErc20));

+ }

+ assert(address(lPool) != address(newLPool));

+

+ // Malicious actor can use the signature extracted from the mempool to

+ // request redemption from the different liquidity pool

+ vm.prank(makeAddr("malicious"));

+ newLPool.requestRedeemWithPermit(maxMint, investor, block.timestamp, v, r, s);

+

+ // User's transaction will fail since the signature has already been used

+ vm.expectRevert();

+ lPool.requestRedeemWithPermit(maxMint, investor, block.timestamp, v, r, s);

+}

+```

+

+### Recommended Mitigation Steps

+

+One of the ways to mitigate this issue is to add some identifier of the liquidity pool to the permit message. This way permit will be linked to a specific liquidity pool.

+

+**[hieronx (Centrifuge) confirmed and commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/227#issuecomment-1745023712):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/159

+

+

+

+***

+

+## [[M-03] Cached `DOMAIN_SEPARATOR` is incorrect for tranche tokens potentially breaking permit integrations](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/146)

+*Submitted by [Kow](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/146), also found by [0xRobsol](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/746), [codegpt](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/730), [0xkazim](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/710), [josephdara](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/697), [Aymen0909](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/586), 0xpiken ([1](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/539), [2](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/345)), [bin2chen](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/536), [nmirchev8](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/426), rvierdiiev ([1](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/404), [2](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/402)), lsaudit ([1](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/313), [2](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/306)), [0xfuje](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/247), [gumgumzum](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/214), [T1MOH](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/102), and ravikiranweb3 ([1](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/65), [2](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/52), [3](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/51))*

+

+Attempts to interact with tranche tokens via `permit` may always revert.

+

+### Proof of Concept

+

+When new tranche tokens are deployed, the initial `DOMAIN_SEPARATOR` is calculated and cached in the constructor.

+

+

+```solidity

+ constructor(uint8 decimals_) {

+ ...

+ deploymentChainId = block.chainid;

+ _DOMAIN_SEPARATOR = _calculateDomainSeparator(block.chainid);

+ }

+```

+

+This uses an empty string since `name` is only set after deployment.

+

+

+```solidity

+ function newTrancheToken(

+ uint64 poolId,

+ bytes16 trancheId,

+ string memory name,

+ string memory symbol,

+ uint8 decimals,

+ address[] calldata trancheTokenWards,

+ address[] calldata restrictionManagerWards

+ ) public auth returns (address) {

+ ...

+ TrancheToken token = new TrancheToken{salt: salt}(decimals);

+

+ token.file("name", name);

+ ...

+ }

+```

+

+Consequently, the domain separator is incorrect (when `block.chainid == deploymentChainId` where the domain separator is not recalculated) and will cause reverts when signatures for `permit` are attempted to be constructed using the tranche token's `name` (which will not be empty).

+

+It should also be noted that the tranche token `name` could be changed by a call to `updateTranchTokenMetadata` which may also introduce complications with the domain separator.

+

+### Recommended Mitigation Steps

+

+Consider setting the name in the constructor before the cached domain separator is calculated.

+

+**[hieronx (Centrifuge) confirmed and commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/146#issuecomment-1745025208):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/142

+

+

+

+***

+

+## [[M-04] You can deposit really small amount for other users to DoS them](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/143)

+*Submitted by [0x3b](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/143), also found by [jaraxxus](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/686) and [twicek](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/283)*

+

+Deposit and mint under [**LiquidityPool**](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L152) lack access control, which enables any user to **proceed** the mint/deposit for another user. Attacker can deposit (this does not require tokens) some wai before users TX to DoS the deposit.

+

+### Proof of Concept

+

+[deposit](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L144) and [mint](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L148-L152) do [processDeposit](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L427-L441)/[processMint](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L451-L465) which are the secondary functions to the requests. These function do not take any value in the form of tokens, but only send shares to the receivers. This means they can be called for free.

+

+With this an attacker who wants to DoS a user, can wait him to make the request to deposit and on the next epoch front run him by calling [deposit](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L144) with something small like 1 wei. Afterwards when the user calls `deposit`, his TX will inevitable revert, as he will not have enough balance for the full deposit.

+

+### Recommended Mitigation Steps

+

+Have some access control modifiers like [**withApproval**](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L97-L100) used also in [redeem](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L200-L208).

+

+```diff

+- function deposit(uint256 assets, address receiver) public returns (uint256 shares) {

++ function deposit(uint256 assets, address receiver) public returns (uint256 shares) withApproval(receiver) {

+ shares = investmentManager.processDeposit(receiver, assets);

+ emit Deposit(address(this), receiver, assets, shares);

+ }

+

+- function mint(uint256 shares, address receiver) public returns (uint256 assets) {

++ function mint(uint256 shares, address receiver) public returns (uint256 assets) withApproval(receiver) {

+ assets = investmentManager.processMint(receiver, shares);

+ emit Deposit(address(this), receiver, assets, shares);

+ }

+```

+

+### Assessed type

+

+Access Control

+

+**[hieronx (Centrifuge) confirmed and commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/143#issuecomment-1745028559):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/136

+

+

+

+***

+

+## [[M-05] Investors claiming their `maxDeposit` by using the `LiquidityPool.deposit()` will cause other users to be unable to claim their `maxDeposit`/`maxMint`](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/118)

+*Submitted by [0xStalin](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/118), also found by [Aymen0909](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/647), [imtybik](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/532), [HChang26](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/321), and [J4X](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/210)*

+

+Claiming deposits using the [`LiquidityPool.deposit()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L144) will cause the Escrow contract to not have enough shares to allow other investors to claim their maxDeposit or maxMint values for their deposited assets.

+

+### Proof of Concept

+

+* Before an investor can claim their deposits, they first needs to request the deposit and wait for the Centrigue Chain to validate it in the next epoch.

+

+* Investors can request deposits at different epochs without the need to claim all the approved deposits before requesting a new deposit, in the end, the maxDeposit and maxMint values that the investor can claim will be increased accordingly based on all the request deposits that the investor makes.

+

+* When the requestDeposit of the investor is processed in the Centrifuge chain, a number of TrancheShares will be minted based on the price at the moment when the request was processed and the total amount of deposited assets, this TrancheShares will be deposited to the Escrow contract, and the TrancheShares will be waiting for the investors to claim their deposits.

+

+* When investors decide to claim their deposit they can use the [`LiquidityPool.deposit()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L144) function, this function receives as arguments the number of assets that are being claimed and the address of the account to claim the deposits for.

+

+```solidity

+function deposit(uint256 assets, address receiver) public returns (uint256 shares) {

+ shares = investmentManager.processDeposit(receiver, assets);

+ emit Deposit(address(this), receiver, assets, shares);

+}

+```

+

+* The [`LiquidityPool.deposit()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L144) function calls the [`InvestmentManager::processDeposit()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L427-L441) which will validate that the amount of assets being claimed doesn't exceed the investor's deposit limits, will compute the deposit price in the [`InvestmentManager::calculateDepositPrice()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L551-L558), which basically computes an average price for all the request deposits that have been accepted in the Centrifuge Chain, each of those request deposits could've been executed at a different price, so, this function, based on the values of maxDeposit and maxMint will estimate an average price for all the unclaimed deposits, later, using this computed price for the deposits will compute the equivalent of TrancheTokens for the CurrencyAmount being claimed, and finally, processDeposit() will transferFrom the escrow to the investor account the computed amount of TranchTokens.

+

+```solidity

+function processDeposit(address user, uint256 currencyAmount) public auth returns (uint256 trancheTokenAmount) {

+ address liquidityPool = msg.sender;

+ uint128 _currencyAmount = _toUint128(currencyAmount);

+ require(

+ //@audit-info => orderbook[][].maxDeposit is updated when the handleExecutedCollectInvest() was executed!

+ //@audit-info => The orderbook keeps track of the number of TrancheToken shares that have been minted to the Escrow contract on the user's behalf!

+ (_currencyAmount <= orderbook[user][liquidityPool].maxDeposit && _currencyAmount != 0),

+ "InvestmentManager/amount-exceeds-deposit-limits"

+ );

+

+ //@audit-info => computes an average price for all the request deposits that have been accepted in the Centrifuge Chain and haven't been claimed yet!

+ uint256 depositPrice = calculateDepositPrice(user, liquidityPool);

+ require(depositPrice != 0, "LiquidityPool/deposit-token-price-0");

+

+ //@audit-info => Based on the computed depositPrice will compute the equivalent of TrancheTokens for the CurrencyAmount being claimed

+ uint128 _trancheTokenAmount = _calculateTrancheTokenAmount(_currencyAmount, liquidityPool, depositPrice);

+

+ //@audit-info => transferFrom the escrow to the investor account the computed amount of TranchTokens.

+ _deposit(_trancheTokenAmount, _currencyAmount, liquidityPool, user);

+ trancheTokenAmount = uint256(_trancheTokenAmount);

+}

+```

+

+**The problem** occurs when an investor hasn't claimed their deposits and has requested multiple deposits on different epochs at different prices. The [`InvestmentManager::calculateDepositPrice()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L551-L558) function will compute an equivalent/average price for all the requestDeposits that haven't been claimed yet. Because of the different prices that the request deposits where processed at, the computed price will compute the most accurate average of the deposit's price, but there is a slight rounding error that causes the computed value of trancheTokenAmount to be slightly different from what it should exactly be.

+

+* That slight difference will make that the Escrow contract transfers slightly more shares to the investor claiming the deposits by using the [`LiquidityPool.deposit()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L144)

+* **As a result**, when another investor tries to claim their [maxDeposit](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L129-L132) or [maxMint](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L154-L157), now the Escrow contract doesn't have enough shares to make whole the request of the other investor, and as a consequence the other investor transaction will be reverted. That means the second investor won't be able to claim all the shares that it is entitled to claim because the Escrow contract doesn't have all those shares anymore.

+

+**Coded PoC**

+

+* I used the [`LiquidityPool.t.sol`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/test/LiquidityPool.t.sol) test file as the base file for this PoC, please add the below testPoC to the LiquidityPool.t.sol file

+

+* In this PoC I demonstrate that Alice (A second investor) won't be able to claim her maxDeposit or maxMint amounts after the first investor uses the [`LiquidityPool.deposit()`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L141-L144) function to claim his [maxDeposit() assets](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/LiquidityPool.sol#L129-L132). The first investor makes two requestDeposit, each of them at a different epoch and at a different price, Alice on the other hand only does 1 requestDeposit in the second epoch.

+

+* Run this PoC two times, check the comments on the last 4 lines, one time we want to test Alice claiming her deposits using LiquidityPool::deposit(), and the second time using LiquidityPool::mint()

+ * The two executions should fail with the same problem.

+

+

+

+```solidity

+ function testDepositAtDifferentPricesPoC(uint64 poolId, bytes16 trancheId, uint128 currencyId) public {

+ vm.assume(currencyId > 0);

+

+ uint8 TRANCHE_TOKEN_DECIMALS = 18; // Like DAI

+ uint8 INVESTMENT_CURRENCY_DECIMALS = 6; // 6, like USDC

+

+ ERC20 currency = _newErc20("Currency", "CR", INVESTMENT_CURRENCY_DECIMALS);

+ address lPool_ =

+ deployLiquidityPool(poolId, TRANCHE_TOKEN_DECIMALS, "", "", trancheId, currencyId, address(currency));

+ LiquidityPool lPool = LiquidityPool(lPool_);

+ homePools.updateTrancheTokenPrice(poolId, trancheId, currencyId, 1000000000000000000);

+

+ //@audit-info => Add Alice as a Member

+ address alice = address(0x23232323);

+ homePools.updateMember(poolId, trancheId, alice, type(uint64).max);

+

+ // invest

+ uint256 investmentAmount = 100000000; // 100 * 10**6

+ homePools.updateMember(poolId, trancheId, self, type(uint64).max);

+ currency.approve(address(investmentManager), investmentAmount);

+ currency.mint(self, investmentAmount);

+ lPool.requestDeposit(investmentAmount, self);

+

+ // trigger executed collectInvest at a price of 1.25

+ uint128 _currencyId = poolManager.currencyAddressToId(address(currency)); // retrieve currencyId

+ uint128 currencyPayout = 100000000; // 100 * 10**6

+ uint128 firstTrancheTokenPayout = 80000000000000000000; // 100 * 10**18 / 1.25, rounded down

+ homePools.isExecutedCollectInvest(

+ poolId, trancheId, bytes32(bytes20(self)), _currencyId, currencyPayout, firstTrancheTokenPayout

+ );

+

+ // assert deposit & mint values adjusted

+ assertEq(lPool.maxDeposit(self), currencyPayout);

+ assertEq(lPool.maxMint(self), firstTrancheTokenPayout);

+

+ // deposit price should be ~1.25*10**18 === 1250000000000000000

+ assertEq(investmentManager.calculateDepositPrice(self, address(lPool)), 1250000000000000000);

+

+

+ // second investment in a different epoch => different price

+ currency.approve(address(investmentManager), investmentAmount);

+ currency.mint(self, investmentAmount);

+ lPool.requestDeposit(investmentAmount, self);

+

+ // trigger executed collectInvest at a price of 2

+ currencyPayout = 100000000; // 100 * 10**6

+ uint128 secondTrancheTokenPayout = 50000000000000000000; // 100 * 10**18 / 1.4, rounded down

+ homePools.isExecutedCollectInvest(

+ poolId, trancheId, bytes32(bytes20(self)), _currencyId, currencyPayout, secondTrancheTokenPayout

+ );

+

+ // Alice invests the same amount as the other investor in the second epoch - Price is at 2

+ currency.mint(alice, investmentAmount);

+

+ vm.startPrank(alice);

+ currency.approve(address(investmentManager), investmentAmount);

+ lPool.requestDeposit(investmentAmount, alice);

+ vm.stopPrank();

+

+ homePools.isExecutedCollectInvest(

+ poolId, trancheId, bytes32(bytes20(alice)), _currencyId, currencyPayout, secondTrancheTokenPayout

+ );

+

+ uint128 AliceTrancheTokenPayout = 50000000000000000000; // 100 * 10**18 / 1.4, rounded down

+

+ //@audit-info => At this point, the Escrow contract should have the firstTrancheTokenPayout + secondTrancheTokenPayout + AliceTrancheTokenPayout

+ assertEq(lPool.balanceOf(address(escrow)),firstTrancheTokenPayout + secondTrancheTokenPayout + AliceTrancheTokenPayout);

+

+

+ // Investor collects his the deposited assets using the LiquidityPool::deposit()

+ lPool.deposit(lPool.maxDeposit(self), self);

+

+

+ // Alice tries to collect her deposited assets and gets her transactions reverted because the Escrow doesn't have the required TokenShares for Alice!

+ vm.startPrank(alice);

+

+ //@audit-info => Run the PoC one time to test Alice trying to claim their deposit using LiquidityPool.deposit()

+ lPool.deposit(lPool.maxDeposit(alice), alice);

+

+ //@audit-info => Run the PoC a second time, but now using LiquidityPool.mint()

+ // lPool.mint(lPool.maxMint(alice), alice);

+ vm.stopPrank();

+ }

+```

+

+

+

+### Recommended Mitigation Steps

+

+* I'd recommend to add a check to the computed value of the [`_trancheTokenAmount`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L438) in the `InvestmentManager::processDeposit()`, if the `_trancheTokenAmount` exceeds the `maxMint()` of the user, update it and set it to be the maxMint(), in this way, the rounding differences will be discarded before doing the actual transfer of shares from the Escrow to the user, and this will prevent the Escrow from not having all the required TranchToken for the other investors

+

+```solidity

+function processDeposit(address user, uint256 currencyAmount) public auth returns (uint256 trancheTokenAmount) {

+ address liquidityPool = msg.sender;

+ uint128 _currencyAmount = _toUint128(currencyAmount);

+ require(

+ (_currencyAmount <= orderbook[user][liquidityPool].maxDeposit && _currencyAmount != 0),

+ "InvestmentManager/amount-exceeds-deposit-limits"

+ );

+

+ uint256 depositPrice = calculateDepositPrice(user, liquidityPool);

+ require(depositPrice != 0, "LiquidityPool/deposit-token-price-0");

+

+ uint128 _trancheTokenAmount = _calculateTrancheTokenAmount(_currencyAmount, liquidityPool, depositPrice);

+

+ //@audit => Add this check to prevent any rounding errors from causing problems when transfering shares from the Escrow to the Investor!

++ if (_trancheTokenAmount > orderbook[user][liquidityPool].maxMint) _trancheTokenAmount = orderbook[user][liquidityPool].maxMint;

+

+ _deposit(_trancheTokenAmount, _currencyAmount, liquidityPool, user);

+ trancheTokenAmount = uint256(_trancheTokenAmount);

+}

+```

+

+* After applying the suggested recommendation, you can use the provided PoC on this report to verify that the problem has been solved.

+

+### Assessed type

+

+Math

+

+**[hieronx (Centrifuge) confirmed](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/118#issuecomment-1728512469)**

+

+**[hieronx (Centrifuge) commented via duplicate issue `#210`](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/210#issuecomment-1728512207):**

+ > I believe issues [210](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/210), [34](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/34) and [118](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/118) all come down to the same underlying issues, and I will try to respond with our current understanding (although we are still digging further).

+>

+> There are actually multiple rounding issues coming together in the system right now:

+> 1. If there are multiple executions of an order, there can be loss of precision when these values are added to each other.

+> 2. If there are multiple `deposit` or `mint` calls, there can be loss of precision in the amount of tranche tokens they receive, based on the computed deposit price.

+> 3. If there are multiple `deposit` or `mint` calls, there can be loss of precision in the implied new price through the subtracted `maxDeposit` / `maxMint` values.

+>

+> We've written [a new fuzz test](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/210#issuecomment-1728512207), building on the work from the reported findings, that clearly shows the underlying issue.

+>

+> Unfortunately it also makes clear that this issue cannot be solved by the recommended mitigation steps from the 3 different findings on their own, and it requires deeper changes. We are still investigating this.

+>

+> Now, in terms of the severity, it does not directly lead to a loss of funds. As noted in [issue 210](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/210), the `UserEscrow` logic prevents users from withdrawing more currency/funds than they are entitled to. However, it does lead to users being able to receive more tranche tokens (shares). I will leave it to the judges to make a decision on the severity for this.

+>

+> Thanks to the 3 wardens for reporting these issues!

+

+**[gzeon (judge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/118#issuecomment-1733725182):**

+ > This issue described a protocol specific issue with multiple deposit/withdrawal, where [issue 34](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/34) is a generic 4626 rounding issue, and therefore not marked as duplicate of issue 34. In terms of severity, this does not directly lead to a loss of fund but will affect the availability of the protocol, hence Medium.

+

+**[hieronx (Centrifuge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/118#issuecomment-1745029786):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/166

+

+

+

+***

+

+## [[M-06] DelayedAdmin Cannot `PauseAdmin.removePauser`](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/92)

+*Submitted by [ciphermarco](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/92)*

+

+As per the audit repository's documentation, which is confirmed as up-to-date, there are carefully considered emergency scenarios. Among these scenarios, one is described as follows:

+

+:

+

+ **Someone controls 1 pause admin and triggers a malicious `pause()`**

+

+ * The delayed admin is a `ward` on the pause admin and can trigger `PauseAdmin.removePauser`.

+ * It can then trigger `root.unpause()`.

+

+That makes perfect sense from a security perspective. However the provided `DelayedAdmin` implementation lacks the necessary functionality to execute `PauseAdmin.removePauser` in the case of an emergency.

+

+Striving to adhere to the documented [Severity Categorization](https://docs.code4rena.com/awarding/judging-criteria/severity-categorization), I have categorized this as Medium instead of Low. The reason is that it does not qualify as Low due to representing both a "function incorrect as to spec" issue and a critical feature missing from the project's security model. Without this emergency action for `PauseAdmin`, other recovery paths may have to wait for `Root`'s delay period or, at least temporarily, change the protocol's security model to make a recovery. In my view, this aligns with the "Assets not at direct risk, but the function of the protocol or its availability could be impacted" requirement for Medium severity. With that said, I realize the sponsors and judges will ultimately evaluate and categorise it based on their final risk analysis, not mine. I'm simply streamlining the process by presenting my perspective in advance.

+

+### Proof of Concept

+

+In order to remove a pauser from the `PauseAdmin` contract, the `removePause` function must be called:

+

+:

+

+```

+ function removePauser(address user) external auth {

+ pausers[user] = 0;

+ emit RemovePauser(user);

+ }

+```

+

+Since it is a short contract, here is the whole `DelayedAdmin` implementation:

+

+

+

+```

+// SPDX-License-Identifier: AGPL-3.0-only

+pragma solidity 0.8.21;

+

+import {Root} from "../Root.sol";

+import {Auth} from "./../util/Auth.sol";

+

+/// @title Delayed Admin

+/// @dev Any ward on this contract can trigger

+/// instantaneous pausing and unpausing

+/// on the Root, as well as schedule and cancel

+/// new relys through the timelock.

+contract DelayedAdmin is Auth {

+ Root public immutable root;

+

+ // --- Events ---

+ event File(bytes32 indexed what, address indexed data);

+

+ constructor(address root_) {

+ root = Root(root_);

+

+ wards[msg.sender] = 1;

+ emit Rely(msg.sender);

+ }

+

+ // --- Admin actions ---

+ function pause() public auth {

+ root.pause();

+ }

+

+ function unpause() public auth {

+ root.unpause();

+ }

+

+ function scheduleRely(address target) public auth {

+ root.scheduleRely(target);

+ }

+

+ function cancelRely(address target) public auth {

+ root.cancelRely(target);

+ }

+}

+```

+

+No implemented functionalities exist to trigger `PauseAdmin.removePauser`. Additionally, the contract features an unused `event File`,

+a and fails to record the `PauseAdmin`'s address upon initiation or elsewhere.

+

+As anticipated, `Auth` (inherited) also does not handle this responsibility:

+

+To confirm that I did not misunderstand anything, I thoroughly searched the entire audit repository for occurrences of `removePauser`.

+However, I could only find them in `PauseAdmin.sol`, where the function to remove a pauser is implemented, and in a test case that

+directly calls the `PauseAdmin`.

+

+### Recommended Mitigation Steps

+

+**1. Implement the `PauseAdmin.removePauser` Functionality in `DelayedAdmin.sol` with This Diff:**

+

+```diff

+5a6

+> import {PauseAdmin} from "./PauseAdmin.sol";

+13a15

+> PauseAdmin public immutable pauseAdmin;

+18c20

+< constructor(address root_) {

+---

+> constructor(address root_, address pauseAdmin_) {

+19a22

+> pauseAdmin = PauseAdmin(pauseAdmin_);

+41,42c44,48

+< // @audit HM? How can delayed admin call `PauseAdmin.removePauser if not coded here?

+< // @audit According to documentation: "The delayed admin is a ward on the pause admin and can trigger PauseAdmin.removePauser."

+---

+>

+> // --- Emergency actions --

+> function removePauser(address pauser) public auth {

+> pauseAdmin.removePauser(pauser);

+> }

+

+```

+

+**2. Add This Test Function to `AdminTest` Contract in `test/Admin.t.sol`**

+

+```

+ function testEmergencyRemovePauser() public {

+ address evilPauser = address(0x1337);

+ pauseAdmin.addPauser(evilPauser);

+ assertEq(pauseAdmin.pausers(evilPauser), 1);

+

+ delayedAdmin.removePauser(evilPauser);

+ assertEq(pauseAdmin.pausers(evilPauser), 0);

+ }

+```

+

+**3. Change the `DelayedAdmin` Creation in `script/Deployer.sol` with This diff:**

+

+```diff

+55c55

+< delayedAdmin = new DelayedAdmin(address(root));

+---

+> delayedAdmin = new DelayedAdmin(address(root), address(pauseAdmin));

+

+```

+

+**4. Test**

+

+`$ forge test`

+

+**[RaymondFam (lookout) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/92#issuecomment-1720289509):**

+ > The sponsor has highlighted in Discord that these are EOAs capable of triggering to removePauser.

+

+**[gzeon (judge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/92#issuecomment-1735729992):**

+ > Since the `removePauser` usecase is explicitly documented in the README and DelayedAdmin.sol is in-scope, I believe this is a valid Medium issue as the warden described.

+

+**[hieronx (Centrifuge) confirmed and commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/92#issuecomment-1745030969):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/139

+

+

+

+***

+

+## [[M-07] ```trancheTokenAmount``` should be rounded UP when proceeding to a withdrawal or previewing a withdrawal](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/34)

+*Submitted by [pipidu83](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/34), also found by [Vagner](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/798), [KrisApostolov](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/774), [0xTiwa](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/680), [josephdara](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/664), [0xgrbr](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/644), [PENGUN](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/562), [Kral01](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/542), [bitsurfer](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/535), [ether\_sky](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/470), [0xklh](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/444), [merlin](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/421), [maanas](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/367), [Phantasmagoria](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/349), [lsaudit](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/318), [castle\_chain](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/287), [ladboy233](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/281), [deth](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/106), [IceBear](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/105), [0xPacelli](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/82), and [MaslarovK](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/76)*

+

+This is good practice when implementing the EIP-4626 vault standard as it is more secure to favour the vault than its users in that case.

+This can also lead to issues down the line for other protocol integrating Centrifuge, that may assume that rounding was handled according to EIP-4626 best practices.

+

+### Proof of Concept

+

+When calling the [`processWithdraw`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L515) function, the `trancheTokenAmount` is computed through the [`_calculateTrancheTokenAmount`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L591) function, which rounds DOWN the number of shares required to be burnt to receive the `currencyAmount` payout/withdrawal.

+

+```solidity

+/// @dev Processes user's tranche token redemption after the epoch has been executed on Centrifuge.

+/// In case user's redempion order was fullfilled on Centrifuge during epoch execution MaxRedeem and MaxWithdraw

+/// are increased and LiquidityPool currency can be transferred to user's wallet on calling processRedeem or processWithdraw.

+/// Note: The trancheTokenAmount required to fullfill the redemption order was already locked in escrow upon calling requestRedeem and burned upon collectRedeem.

+/// @notice trancheTokenAmount return value is type of uint256 to be compliant with EIP4626 LiquidityPool interface

+/// @return trancheTokenAmount the amount of trancheTokens redeemed/burned required to receive the currencyAmount payout/withdrawel.

+function processWithdraw(uint256 currencyAmount, address receiver, address user)

+public

+auth

+returns (uint256 trancheTokenAmount)

+{

+address liquidityPool = msg.sender;

+uint128 _currencyAmount = _toUint128(currencyAmount);

+require(

+(_currencyAmount <= orderbook[user][liquidityPool].maxWithdraw && _currencyAmount != 0),

+"InvestmentManager/amount-exceeds-withdraw-limits"

+);

+

+uint256 redeemPrice = calculateRedeemPrice(user, liquidityPool);

+require(redeemPrice != 0, "LiquidityPool/redeem-token-price-0");

+

+uint128 _trancheTokenAmount = _calculateTrancheTokenAmount(_currencyAmount, liquidityPool, redeemPrice);

+_redeem(_trancheTokenAmount, _currencyAmount, liquidityPool, receiver, user);

+trancheTokenAmount = uint256(_trancheTokenAmount);

+}

+```

+

+```solidity

+function _calculateTrancheTokenAmount(uint128 currencyAmount, address liquidityPool, uint256 price)

+internal

+view

+returns (uint128 trancheTokenAmount)

+{

+(uint8 currencyDecimals, uint8 trancheTokenDecimals) = _getPoolDecimals(liquidityPool);

+

+uint256 currencyAmountInPriceDecimals = _toPriceDecimals(currencyAmount, currencyDecimals, liquidityPool).mulDiv(

+10 ** PRICE_DECIMALS, price, MathLib.Rounding.Down

+);

+

+trancheTokenAmount = _fromPriceDecimals(currencyAmountInPriceDecimals, trancheTokenDecimals, liquidityPool);

+}

+```

+

+As an additional reason the round UP the amount, the computed amount of shares is also used to [`_decreaseRedemptionLimits`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L635C14-L635C39), which could potentially lead to a rounded UP remaining redemption limit post withdrawal (note that for the same reason it would we wise to round UP the `_currency` amount as well when calling `_decreaseRedemptionLimits`).

+

+The same function is used in the [`previewWithdraw`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L396) function, where is should be rounded UP for the same reasons.

+

+```solidity

+/// @return trancheTokenAmount is type of uin256 to support the EIP4626 Liquidity Pool interface

+function previewWithdraw(address user, address liquidityPool, uint256 _currencyAmount)

+public

+view

+returns (uint256 trancheTokenAmount)

+{

+uint128 currencyAmount = _toUint128(_currencyAmount);

+uint256 redeemPrice = calculateRedeemPrice(user, liquidityPool);

+if (redeemPrice == 0) return 0;

+

+trancheTokenAmount = uint256(_calculateTrancheTokenAmount(currencyAmount, liquidityPool, redeemPrice));

+}

+```

+

+### Tools Used

+

+Visual Studio / Manual Review

+

+### Recommended Mitigation Steps

+

+As the we do not always want to round the amount of shares UP in [`_calculateTrancheTokenAmount`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L591) (e.g. when used in [`previewDeposit`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L370) or [`processDeposit`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L427) the shares amount is correctly rounded DOWN), the function would actually require an extra argument like below:

+

+```solidity

+function _calculateTrancheTokenAmount(uint128 currencyAmount, address liquidityPool, uint256 price, Math.Rounding rounding)

+internal

+view

+returns (uint128 trancheTokenAmount)

+{

+(uint8 currencyDecimals, uint8 trancheTokenDecimals) = _getPoolDecimals(liquidityPool);

+

+uint256 currencyAmountInPriceDecimals = _toPriceDecimals(currencyAmount, currencyDecimals, liquidityPool).mulDiv(

+10 ** PRICE_DECIMALS, price, MathLib.Rounding.Down

+);

+

+trancheTokenAmount = _fromPriceDecimals(currencyAmountInPriceDecimals, trancheTokenDecimals, liquidityPool);

+}

+```

+

+And be used as

+

+```solidity

+_calculateTrancheTokenAmount(currencyAmount, liquidityPool, redeemPrice, Math.Rounding.Ceil)

+```

+

+In [`previewWithdraw`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L396) and [`processWithdraw`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L515)

+

+And

+

+```solidity

+_calculateTrancheTokenAmount(_currencyAmount, liquidityPool, depositPrice, Math.Rounding.Floor)

+```

+

+In [`previewDeposit`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L370) and [`processDeposit`](https://github.com/code-423n4/2023-09-centrifuge/blob/main/src/InvestmentManager.sol#L427).

+

+### Assessed type

+

+Math

+

+**[hieronx (Centrifuge) confirmed and commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/34#issuecomment-1745030227):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/166

+

+***

+

+## [[M-08] The Restriction Manager does not completely implement ERC1404 which leads to accounts that are supposed to be restricted actually having access to do with their tokens as they see fit](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/779)

+*Submitted by [Bauchibred](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/779), also found by [josephdara](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/792), [ast3ros](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/625), [Ch\_301](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/413), [BARW](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/388), [0xnev](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/356), [degensec](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/49), and [J4X](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/14)*

+

+Medium, contract's intended logic is for *blacklisted* users not to be able to interact with their system so as to follow rules set by regulationary bodies in the case where a user does anything that warrants them to be blacklisted, but this is clearly broken since only half the window is closed as current implementation only checks on receiver being blacklisted and not sender.

+

+### Proof of Concept

+

+The current implementation of the ERC1404 restrictions within the `RestrictionManager.sol` contract only places restrictions on the receiving address in token transfer instances. This oversight means that the sending addresses are not restricted, which poses a regulatory and compliance risk. Should a user be `blacklisted` for any reason, they can continue to transfer tokens as long as the receiving address is a valid member. This behaviour is contrary to expectations from regulatory bodies, especially say in the U.S where these bodies are very strict and a little in-compliance could land Centrifuge a lawsuit., which may expect complete trading restrictions for such blacklisted individuals.

+

+Within the `RestrictionManager` contract, the method `detectTransferRestriction` only checks if the receiving address (`to`) is a valid member:

+

+[RestrictionManager.sol#L28-L34](https://github.com/code-423n4/2023-09-centrifuge/blob/512e7a71ebd9ae76384f837204216f26380c9f91/src/token/RestrictionManager.sol#L28-L34)

+

+```solidity

+function detectTransferRestriction(address from, address to, uint256 value) public view returns (uint8) {

+ if (!hasMember(to)) {

+ return DESTINATION_NOT_A_MEMBER_RESTRICTION_CODE;

+ }

+ return SUCCESS_CODE;

+}

+```

+

+In the above code, the sending address (`from`) is never checked against the membership restrictions, which means blacklisted users can still initiate transfers and when checking the transfer restriction from both `tranchtoken.sol` and the `liquiditypool.sol` it's going to wrongly return true for a personnel that should be false

+

+See [Tranche.sol#L80-L82)](https://github.com/code-423n4/2023-09-centrifuge/blob/512e7a71ebd9ae76384f837204216f26380c9f91/src/token/Tranche.sol#L80-L82)

+

+```solidity

+// function checkTransferRestriction(address from, address to, uint256 value) public view returns (bool) {

+// return share.checkTransferRestriction(from, to, value);

+// }

+```

+

+Also [Tranche.sol#L35-L39](https://github.com/code-423n4/2023-09-centrifuge/blob/512e7a71ebd9ae76384f837204216f26380c9f91/src/token/Tranche.sol#L35-L39)

+

+```solidity

+ modifier restricted(address from, address to, uint256 value) {

+ uint8 restrictionCode = detectTransferRestriction(from, to, value);

+ require(restrictionCode == restrictionManager.SUCCESS_CODE(), messageForTransferRestriction(restrictionCode));

+ _;

+ }

+```

+

+This function suggests that the system's logic may rely on the `detectTransferRestriction` method in other parts of the ecosystem. Consequently, if the restriction manager's logic is flawed, these other parts may also allow unauthorised transfers.

+

+**Foundry POC**

+

+Add this to the `Tranche.t.sol` contract

+

+```solidity

+ function testTransferFromTokensFromBlacklistedAccountWorks(uint256 amount, address targetUser, uint256 validUntil) public {

+ vm.assume(baseAssumptions(validUntil, targetUser));

+

+ restrictionManager.updateMember(targetUser, validUntil);

+ assertEq(restrictionManager.members(targetUser), validUntil);

+ restrictionManager.updateMember(address(this), block.timestamp);

+ assertEq(restrictionManager.members(address(this)), block.timestamp);

+

+ token.mint(address(this), amount);

+ vm.warp(block.timestamp + 1);

+

+ token.transferFrom(address(this), targetUser, amount);

+ assertEq(token.balanceOf(targetUser), amount);

+ }

+```

+

+As seen even after `address(this)` stops being a member they could still transfer tokens to another user in as much as said user is still a member, which means a *blacklisted* user could easily do anything with their tokens all they need to do is to delegate to another member.

+

+### Recommended Mitigation Steps

+

+Refactor`detectTransferRestriction()`, i.e modify the method to also validate the sending address (`from`). Ensure both `from` and `to` addresses are valid members before allowing transfers.

+

+If this is contract's intended logic then this information should be duly passed to the regulatory bodies that a `user` can't really get blacklisted and more of user's could be stopped from receiving tokens.

+

+### Assessed type

+

+Context

+

+**[hieronx (Centrifuge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/779#issuecomment-1734178040):**

+ > This is a design decision. Transferring to a valid member is fine if that destination is still allowed to hold the tokens.

+

+**[gzeon (judge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/779#issuecomment-1735811683):**

+ > > This is a design decision. Transferring to a valid member is fine if that destination is still allowed to hold the tokens.

+>

+> This seems to contradict with `Removing an investor from the memberlist in the Restriction Manager locks their tokens. This is expected behaviour.` (See [here](https://github.com/code-423n4/2023-09-centrifuge/blob/512e7a71ebd9ae76384f837204216f26380c9f91/README.md?plain=1#L140))

+

+**[hieronx (Centrifuge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/779#issuecomment-1735838137):**

+ > Yes you're right, that's unfortunate wording. What I said above is correct, and the text in the README is incorrect. What was meant was that it locks their tranche tokens from being redeemed.

+>

+> It is indeed fair to say though that, based on the README text, the above issue is valid.

+

+**[hieronx (Centrifuge) commented](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/779#issuecomment-1745021967):**

+ > Mitigated in https://github.com/centrifuge/liquidity-pools/pull/138

+

+***

+

+# Low Risk and Non-Critical Issues

+

+For this audit, 39 reports were submitted by wardens detailing low risk and non-critical issues. The [report highlighted below](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/548) by **castle_chain** received the top score from the judge.

+

+*The following wardens also submitted reports: [Bauchibred](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/784), [0xpiken](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/468), [BARW](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/427), [0xmystery](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/397), [0xfuje](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/392), [0xLook](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/770), [merlin](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/767), [MohammedRizwan](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/765), [jkoppel](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/761), [jolah1](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/740), [alexzoid](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/663), [sandy](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/653), [btk](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/649), [Kaysoft](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/642), [klau5](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/636), [ast3ros](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/626), [0xAadi](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/606), [Bughunter101](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/597), [0xblackskull](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/585), [0xnev](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/559), [SanketKogekar](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/545), [m\_Rassska](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/509), [grearlake](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/475), [nobody2018](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/471), [7ashraf](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/463), [JP\_Courses](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/460), [Krace](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/420), [Ch\_301](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/410), [lsaudit](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/319), [catellatech](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/314), [imtybik](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/246), [mrudenko](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/213), [Sathish9098](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/207), [rvierdiiev](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/187), [rokinot](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/46), [fatherOfBlocks](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/43), [0xHelium](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/32), and [degensec](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/25).*

+

+## [L-01] The function `addTranche()` should validate the tranche token decimals to make sure that the decimals are not greater than 18

+

+```solidity

+ function addTranche(

+ uint64 poolId,

+ bytes16 trancheId,

+ string memory tokenName,

+ string memory tokenSymbol,

+ uint8 decimals

+ ) public onlyGateway {

+ Pool storage pool = pools[poolId];

+ require(pool.createdAt != 0, "PoolManager/invalid-pool");

+ Tranche storage tranche = pool.tranches[trancheId];

+ require(tranche.createdAt == 0, "PoolManager/tranche-already-exists");

+

+

+ tranche.poolId = poolId;

+ tranche.trancheId = trancheId;

+ @> tranche.decimals = decimals;

+ tranche.tokenName = tokenName;

+ tranche.tokenSymbol = tokenSymbol;

+ tranche.createdAt = block.timestamp;

+

+

+ emit TrancheAdded(poolId, trancheId);

+ }

+```

+

+## [[L-02] Unlimiting the delay period with minimum threshold allows the delay period to be set too low and allows a malicious `ScheduleUpgrade` message to be executed on the root contract and gain access on the other contracts](https://github.com/code-423n4/2023-09-centrifuge-findings/issues/298)

+

+*Note: this finding was originally submitted separately by the warden at a higher severity; however, it was downgraded to low severity and considered by the judge in scoring. It is being included here for completeness.*

+

+Allowing to modify the delay period without minimum threshold can result in set the `delay` period to a too short period or even zero ,which is allowed according to the code , and this could lead to allowing a malicious `ScheduleUpgrade` message to pass and a malicious account can gain control over all the contracts of the protocols.

+

+### Proof of Concept

+In the `Root.sol ` contract, the protocol implements a maximum threshold in the function `file()` which can modify the `delay` variable, so the possibility of the set the delay period to a very long period exists and also setting the delay period to a very short period is still possible, as shown in the `file()` which will not prevent set the `delay` period to zero or any short period :

+```solidity

+ function file(bytes32 what, uint256 data) external auth {

+ if (what == "delay") {

+ require(data <= MAX_DELAY, "Root/delay-too-long");

+ delay = data;

+ } else {

+ revert("Root/file-unrecognized-param");

+ }

+ emit File(what, data);

+```

+So if the `delay` was set to a very short period and Someone gains control over a router and triggers a malicious `ScheduleUpgrade` message , the malicious attacker can trigger the `executeScheduledRely()` function after the `delay` period, which is too short, to give his address or any contract an `auth` role on any of the protocol contracts, the attacker can be `auth` on the `escrow` contract and steals all the funds from the protocol.

+

+This attack does not assume that the `auth` admin on the `Root` contract is malicious, but it is all about the possibility of setting the `delay` period to a very short period or even zero, which can be happened mistakenly or intentionally.

+

+### Recommended Mitigation Steps

+This vulnerability can be mitigated by implementing a minimum threshold `MIN_DELAY` to the `delay` period, so this will prevent setting the `delay` period to zero or even a very short period.

+```diff

++ uint256 private MIN_DELAY = 2 days ;

+

+ function file(bytes32 what, uint256 data) external auth {

+ if (what == "delay") {

+ require(data <= MAX_DELAY, "Root/delay-too-long");

++ require(data >= MIN_DELAY, "Root/delay-too-short");

+

+ delay = data;

+ } else {

+ revert("Root/file-unrecognized-param");

+ }

+ emit File(what, data);

+```

+

+## [N-01] Unnecessary checks can be removed, to enhance the code

+

+https://github.com/code-423n4/2023-09-centrifuge/blob/512e7a71ebd9ae76384f837204216f26380c9f91/src/PoolManager.sol#L310

+

+The `require` keyword can be removed in the function `deployLiquidityPool ()`, because the function `isAllowedAsPoolCurrency` revert on failure in case of the currency is not supported and always return true on success, so if the check fails the function will revert without executing the `require` key word.

+```