Hum Capital offers a single destination where companies can understand all of their financing options and be matched with pre-qualified investors.

Hum Capital offers a single destination where companies can understand all of their financing options and be matched with pre-qualified investors.

Bueno makes it easy for people to manage their property abroad by combining financial services with innovative solutions.

Bueno makes it easy for people to manage their property abroad by combining financial services with innovative solutions.

Cryptocurrency is about to become more accessible, thanks to a new mandate by the United States Office of the Comptroller of Currency (OCC). Now, National Banks and Federal Savings Associations “of all sizes” can provide cryptocurrency custody to customers, a report from The Block notes.

Cryptocurrency is about to become more accessible, thanks to a new mandate by the United States Office of the Comptroller of Currency (OCC). Now, National Banks and Federal Savings Associations “of all sizes” can provide cryptocurrency custody to customers, a report from The Block notes.

We have now established the market's

opened income.

We have now established the market's

opened income.

For some time now, the concepts of asset tokenization and digital tokens have been gaining much traction in the FinTech industry with the latter being used to represent various assets on a blockchain.

For some time now, the concepts of asset tokenization and digital tokens have been gaining much traction in the FinTech industry with the latter being used to represent various assets on a blockchain.

Don't buy another stock without reading these 16 tips: Here are 16 tips when looking at when a stock.

Don't buy another stock without reading these 16 tips: Here are 16 tips when looking at when a stock.

Today, companies that use stock-based lending to finance their businesses generally borrow at higher costs than if they used traditional debt financing.

Today, companies that use stock-based lending to finance their businesses generally borrow at higher costs than if they used traditional debt financing.

You know the hype is real when even the World Economic Forum writes that ChatGPT is just the start of the generative AI boom.

You know the hype is real when even the World Economic Forum writes that ChatGPT is just the start of the generative AI boom.

Creating a card program can be challenging. Find out how Marqeta’s RiskControl portfolio mitigates risk and satisfies compliance needs.

Creating a card program can be challenging. Find out how Marqeta’s RiskControl portfolio mitigates risk and satisfies compliance needs.

Sean Rach, the co-founder of a not-for-profit finance service platform hi, talks about the digital finance ecosystem and the evolution of the crypto markets.

Sean Rach, the co-founder of a not-for-profit finance service platform hi, talks about the digital finance ecosystem and the evolution of the crypto markets.

A look at how the financial services industry is making moves toward lowering its carbon footprint.

A look at how the financial services industry is making moves toward lowering its carbon footprint.

Mount Wish was nominated as one of the best startups in New York City in Startups of the Year hosted by HackerNoon.

Mount Wish was nominated as one of the best startups in New York City in Startups of the Year hosted by HackerNoon.

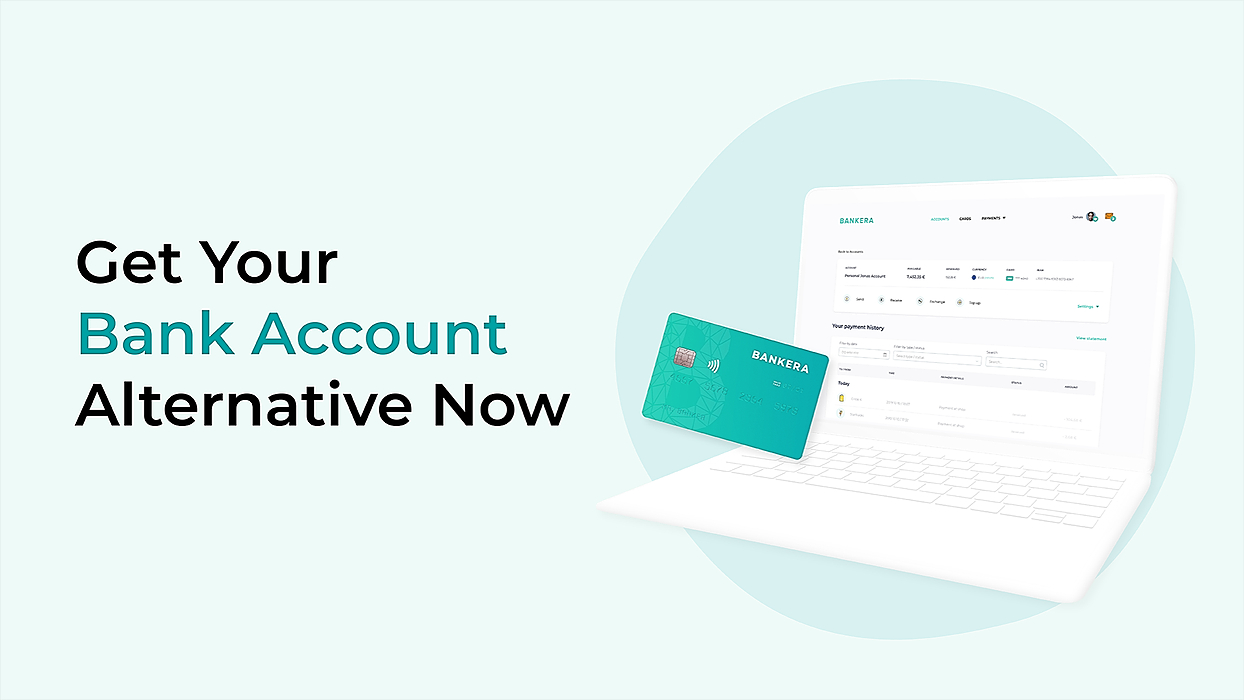

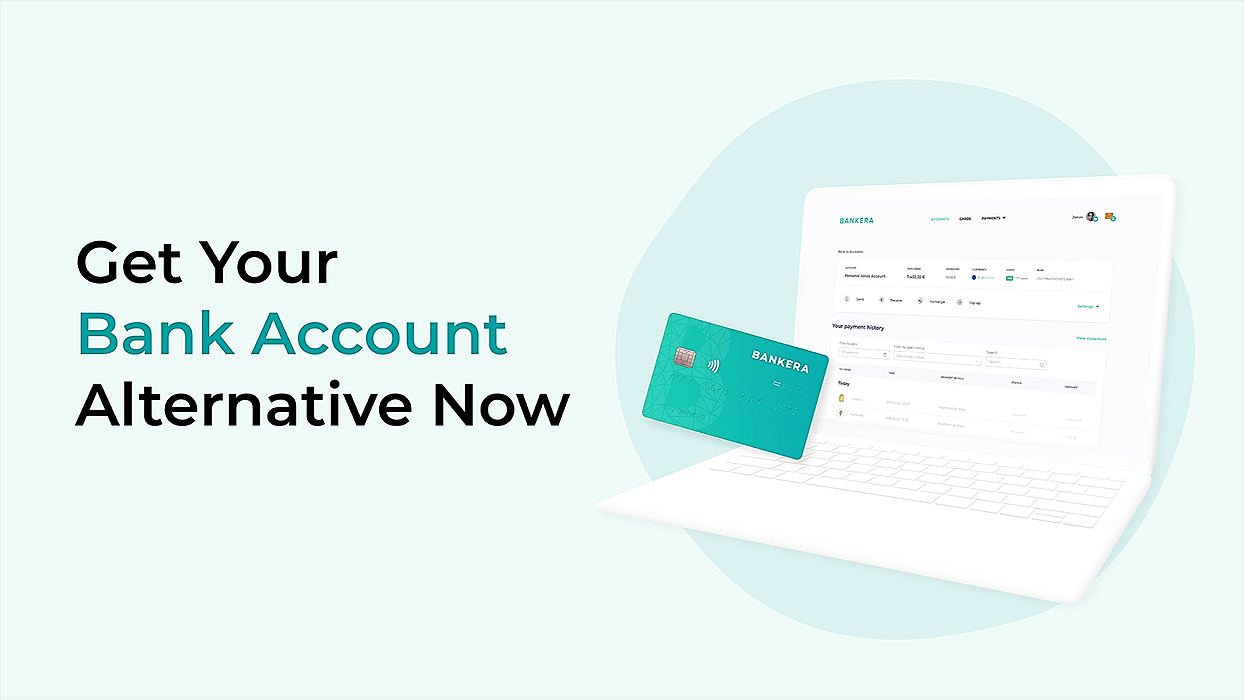

Bankera, an ambitious project to build a neobank for the digital era, has started to offer payment accounts to individual and business clients as a low-cost, fast and convenient alternative to traditional bank accounts. Individual and business clients who sign up to the service can already enjoy dedicated European IBAN accounts to send and receive funds via SEPA and SWIFT transfers. All clients can send and receive funds from cryptocurrency exchanges.

Bankera, an ambitious project to build a neobank for the digital era, has started to offer payment accounts to individual and business clients as a low-cost, fast and convenient alternative to traditional bank accounts. Individual and business clients who sign up to the service can already enjoy dedicated European IBAN accounts to send and receive funds via SEPA and SWIFT transfers. All clients can send and receive funds from cryptocurrency exchanges.

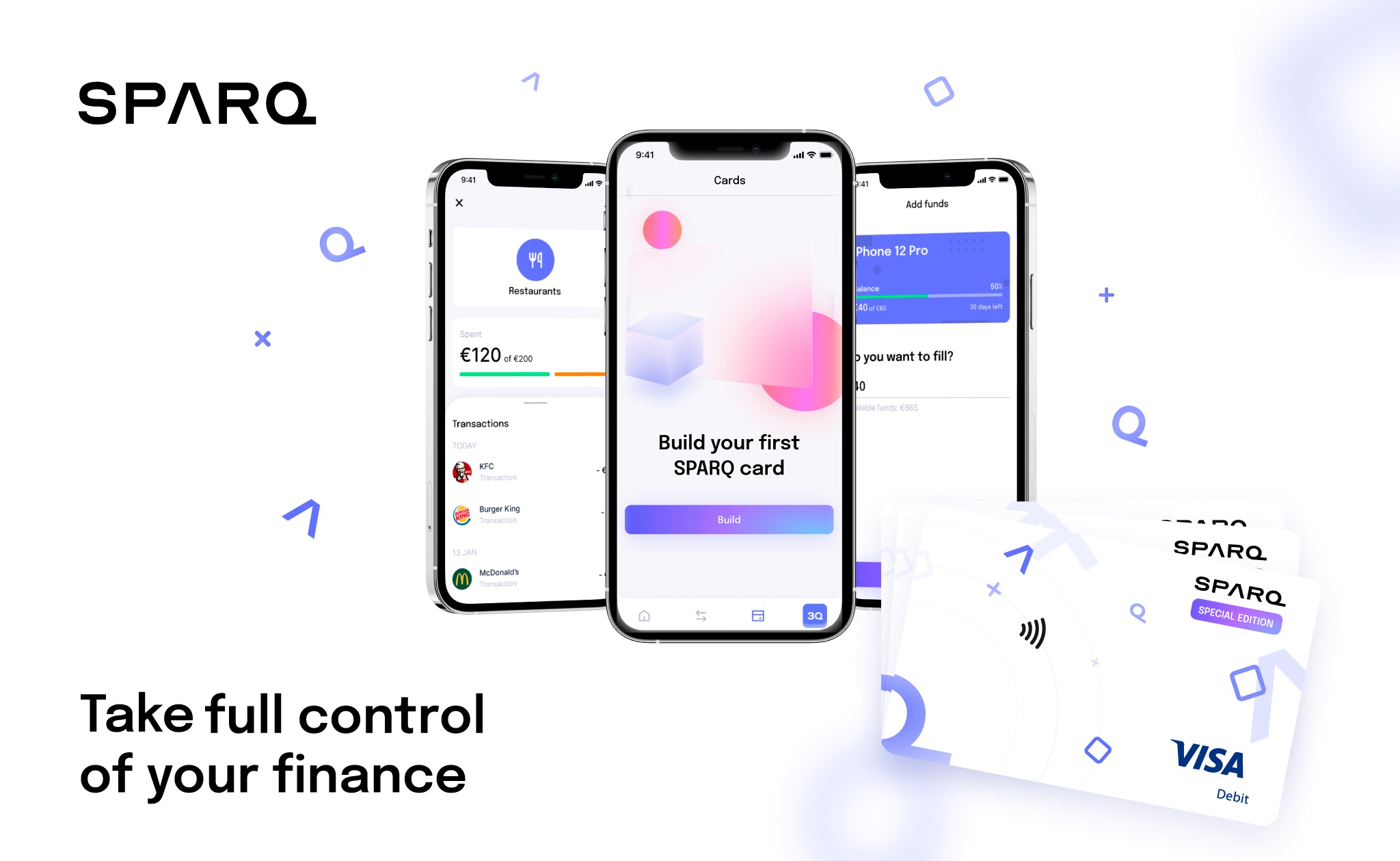

After months of validating the concept and testing the app, SPARQ’s time has finally come!

After months of validating the concept and testing the app, SPARQ’s time has finally come!

Digital banking has exploded in popularity this year, leading to a sharp rise in interest and increased attention from the traditional finance sector.

Digital banking has exploded in popularity this year, leading to a sharp rise in interest and increased attention from the traditional finance sector.

An entrepreneur needs a roadmap for growing his or her business into the “next big thing,” but the road ahead is a dead-end path without capital funding.

An entrepreneur needs a roadmap for growing his or her business into the “next big thing,” but the road ahead is a dead-end path without capital funding.

The rise of bank bail-ins: Understanding what they mean and how they can affect your funds.

The rise of bank bail-ins: Understanding what they mean and how they can affect your funds.

The state of our personal finances says much about us, our lives, and the times we live in. For young people, now becoming financially independent for the first time in their lives, planning their finances is perhaps more complicated than it has ever been. What are the struggles and complexities they face? And how can cutting edge personal finance platforms enable them to better understand where they stand with their finances?

The state of our personal finances says much about us, our lives, and the times we live in. For young people, now becoming financially independent for the first time in their lives, planning their finances is perhaps more complicated than it has ever been. What are the struggles and complexities they face? And how can cutting edge personal finance platforms enable them to better understand where they stand with their finances?

Want to find out what's next in FinTech and the importance of scalable, reliable technologies in the sector? Abstract from new 'FinTech Trends in 2021 Report'.

Want to find out what's next in FinTech and the importance of scalable, reliable technologies in the sector? Abstract from new 'FinTech Trends in 2021 Report'.

The past 12 months have seen an explosion in the digital banking (or neobank), industry, with a wave of new high-quality online banks bursting on to the market. Initially, many of these new banks were simply third-party banking apps with very limited functionality, focusing largely on students and travelers looking to save money with reduced fees.

The past 12 months have seen an explosion in the digital banking (or neobank), industry, with a wave of new high-quality online banks bursting on to the market. Initially, many of these new banks were simply third-party banking apps with very limited functionality, focusing largely on students and travelers looking to save money with reduced fees.

Managing your business finances is important for creating stable financial future. Keep reading to know useful tips for financial management in small business.

Managing your business finances is important for creating stable financial future. Keep reading to know useful tips for financial management in small business.

Consumers look for products that enable them to contribute to sustainability. Banks and fintech companies can address this need with innovation.

Consumers look for products that enable them to contribute to sustainability. Banks and fintech companies can address this need with innovation.

Any company, be it a startup or an enterprise, that needs to collaborate with a legacy financial institution has several hurdles to overcome on the way.

Any company, be it a startup or an enterprise, that needs to collaborate with a legacy financial institution has several hurdles to overcome on the way.

How this startup is reshaping global finance by making capital a commodity.

How this startup is reshaping global finance by making capital a commodity.

A long, long time ago (depending on your historical outlook), in a stock market far, far away (depending on where you're currently reading this), risk-seeking Dutchmen congregated in coffee shops (something like that) to trade little pieces of paper, which, in theory, allowed them to reap the profits of voyages to unknown lands where new commodities would be discovered (like sugar and stuff like that). These little pieces of paper would come to be known as stocks (aka stonks).

A long, long time ago (depending on your historical outlook), in a stock market far, far away (depending on where you're currently reading this), risk-seeking Dutchmen congregated in coffee shops (something like that) to trade little pieces of paper, which, in theory, allowed them to reap the profits of voyages to unknown lands where new commodities would be discovered (like sugar and stuff like that). These little pieces of paper would come to be known as stocks (aka stonks).

A rebuttal of crypto skeptics who claim that the cryptocurrency industry is doomed to collapse because of its failure to deliver substantial innovation.

A rebuttal of crypto skeptics who claim that the cryptocurrency industry is doomed to collapse because of its failure to deliver substantial innovation.

Application Programming Interfaces are an integral part of the emerging digital space. Without them, benefiting from many of today’s habitual financial services would be at least difficult if not impossible. In this piece, Andersen’s experts in FinTech software development will tell how API-based IT solutions contribute to the success of banks and financial organizations.

Application Programming Interfaces are an integral part of the emerging digital space. Without them, benefiting from many of today’s habitual financial services would be at least difficult if not impossible. In this piece, Andersen’s experts in FinTech software development will tell how API-based IT solutions contribute to the success of banks and financial organizations.

Virtual economies have become increasingly intertwined with the physical world. How could this change how we approach our in-game finances?

Virtual economies have become increasingly intertwined with the physical world. How could this change how we approach our in-game finances?

You would think that Youtube would at least wait till the holidays are over to hit its creators with this news but apparently, bitcoin and all cryptocurrency talk is now concrete himself and a danger to society. A lot of YouTube creators woke up to find many of their crypto-related videos taken down because youtube sees them as violating their guidelines.

You would think that Youtube would at least wait till the holidays are over to hit its creators with this news but apparently, bitcoin and all cryptocurrency talk is now concrete himself and a danger to society. A lot of YouTube creators woke up to find many of their crypto-related videos taken down because youtube sees them as violating their guidelines.

A slow load time on your devices down the borderline unacceptable in today’s society. The average consumer now expects everything to work instantly.

A slow load time on your devices down the borderline unacceptable in today’s society. The average consumer now expects everything to work instantly.

Personal Finance is something that is, for better or worse, not a required class. Here are some basic things I wish I knew when I started working in software.

Personal Finance is something that is, for better or worse, not a required class. Here are some basic things I wish I knew when I started working in software.

The concept of digital assets has been rapidly evolving over the course of the past several years

The concept of digital assets has been rapidly evolving over the course of the past several years

In this post, we will cover five key areas that are very relevant to most financial services businesses—five topics an organization must “get right”.

In this post, we will cover five key areas that are very relevant to most financial services businesses—five topics an organization must “get right”.

So far in 2022, the entire crypto market has been impacted by wider economic and political uncertainties, led by Bitcoin, with prices down more than 50% over.

So far in 2022, the entire crypto market has been impacted by wider economic and political uncertainties, led by Bitcoin, with prices down more than 50% over.

Although it may seem that the paradigm shift has just begun, the reality is that the financial services sector has already undergone significant changes. Merely think of mobile banking apps, contactless payments, online money transfers, crypto platforms, robo-advisors, and crowdfunding marketplaces. And fintech innovation has definitely had a hand in this evolution.

Although it may seem that the paradigm shift has just begun, the reality is that the financial services sector has already undergone significant changes. Merely think of mobile banking apps, contactless payments, online money transfers, crypto platforms, robo-advisors, and crowdfunding marketplaces. And fintech innovation has definitely had a hand in this evolution.

Would you believe it if you were told you’re more likely to survive a lightning strike than your beloved puppy’s occasional unfriendly bites? As shown by the National Safety Council, the lifetime odds of dying from being bitten by a dog is 1 to 112,400 while the odds of dying from a lightning strike is 1 to 161,856. Although a lightning strike may sound deadlier, the reality is a bit more complex. And here’s the catch.

Would you believe it if you were told you’re more likely to survive a lightning strike than your beloved puppy’s occasional unfriendly bites? As shown by the National Safety Council, the lifetime odds of dying from being bitten by a dog is 1 to 112,400 while the odds of dying from a lightning strike is 1 to 161,856. Although a lightning strike may sound deadlier, the reality is a bit more complex. And here’s the catch.

Blосkсhаіn tесhnоlоgу іѕ оnе of thе lеаdіng іnnоvаtіоnѕ аnd hаѕ thе роtеntіаlѕ tо mаkе оur financial іnduѕtrу mоrе trаnѕраrеnt.

Blосkсhаіn tесhnоlоgу іѕ оnе of thе lеаdіng іnnоvаtіоnѕ аnd hаѕ thе роtеntіаlѕ tо mаkе оur financial іnduѕtrу mоrе trаnѕраrеnt.

Customers are still big on frictionless experiences and because humans are insatiable in their quest to improve life’s meaningfulness, the job is never done.

Customers are still big on frictionless experiences and because humans are insatiable in their quest to improve life’s meaningfulness, the job is never done.

While the global economy is being severely impacted by the coronavirus crisis, we. at Sperax, a Silicon Valley-based blockchain company, are aiming to build a trusted infrastructure for a decentralized economy that provides far greater efficiency, flexibility and self-governance than the traditional economic model. The world needs decentralisation more than ever to bring everyone together, to collaborate and to share the value created.

While the global economy is being severely impacted by the coronavirus crisis, we. at Sperax, a Silicon Valley-based blockchain company, are aiming to build a trusted infrastructure for a decentralized economy that provides far greater efficiency, flexibility and self-governance than the traditional economic model. The world needs decentralisation more than ever to bring everyone together, to collaborate and to share the value created.

When it comes to finance and trade, the currency is a crucial component. Businesses that deal with foreign marketplaces require up-to-date information on currencies and their quickly fluctuating values.

When it comes to finance and trade, the currency is a crucial component. Businesses that deal with foreign marketplaces require up-to-date information on currencies and their quickly fluctuating values.

Learn all about the most recent advances in the usage of augmented reality and virtual reality in the finance sphere with this comprehensive overview.

Learn all about the most recent advances in the usage of augmented reality and virtual reality in the finance sphere with this comprehensive overview.

It may come as a surprise, but MSMEs (Micro, Small and Medium Enterprises) in emerging markets are one of the biggest contributors to their economy - almost 40% of their GDP and 60% of total employment. This is after the fact that 70% of them lack access to credit and basic financial services.

It may come as a surprise, but MSMEs (Micro, Small and Medium Enterprises) in emerging markets are one of the biggest contributors to their economy - almost 40% of their GDP and 60% of total employment. This is after the fact that 70% of them lack access to credit and basic financial services.

Financial services are defined by the International Monetary Fund (IMF) as processes by which consumers or businesses acquire financial goods.

Financial services are defined by the International Monetary Fund (IMF) as processes by which consumers or businesses acquire financial goods.