Simple financial applications & analysis programs written in R language

SHY: The 'SHarpe Yield' Strategy // SHY strategy on the whole Taiwan Stock Market

The R programming language is designed for statistical analysis, and is widely used in many area recently. Here, I will focus on one of the most adopting domain, financial analysis, to demonstrate the strength of R. Besides, I shall pay extra attention to data visualizaiton in R.

The introduced investment strategy, SHY 'SHarpe Yield', has a very simple computation model. It evaluates each stock by the SHY value, simply yield represents in a sharpe ratio way, i.e., its mean divided by its standard deviation. Given a list of sample stocks in folder csv/ (a dozen stock csv files reside), we can compute the SHY values and report the SHY value as follows:

source("shy.R")

shy_list = get_shy_suggestion()Then, it shows

[1] "( 1) 個股:2382, SHY:3.529709"

[1] "( 2) 個股:2912, SHY:3.470507"

[1] "( 3) 個股:1101, SHY:3.037783"

[1] "( 4) 個股:2330, SHY:2.506207"

[1] "( 5) 個股:2207, SHY:2.486131"

[1] "( 6) 個股:2801, SHY:3.330069"

[1] "( 7) 個股:2701, SHY:3.978262"

[1] "( 8) 個股:2357, SHY:2.116582"

[1] "( 9) 個股:2325, SHY:2.385228"

[1] "(10) 個股:1434, SHY:3.511784"

[1] "(11) 個股:2354, SHY:1.811173"

[1] "(12) 個股:0050, SHY:NA"

[1] "(13) 個股:2408, SHY:NA"

Based on the computed SHY value, we can form a strategy that selects stocks with better SHY, for example, buy a bunch of stocks with better SHY value periodically, just as the way as ETF (Exchange Traded Funds) does.

Would you like to believe a strategy is good when someone throws it to you and claims that it is? I hope not.

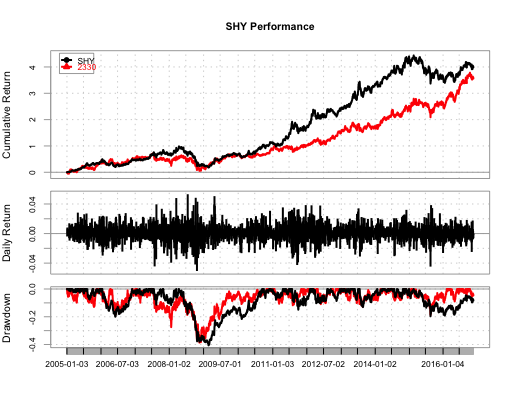

Here, PerformanceAnalytics, a powerful module in finance evaluation in R is adopted, to express the quality of SHY:

source("shy_eval.R")

eval_res = evaluate_shy()The result is then shown in your RStudio console:

(Note: here we buy 3 stocks based on SHY values periodically, among the 11 candidates)

In case that the performance comparison between two targets is interested, we can put the two targets in same evaluation:

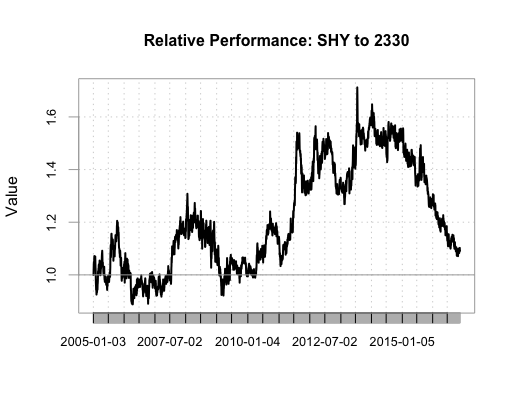

eval_pair_res = evaluate_shy_stock('2330')Another way to compare performance is to use a relative performance view:

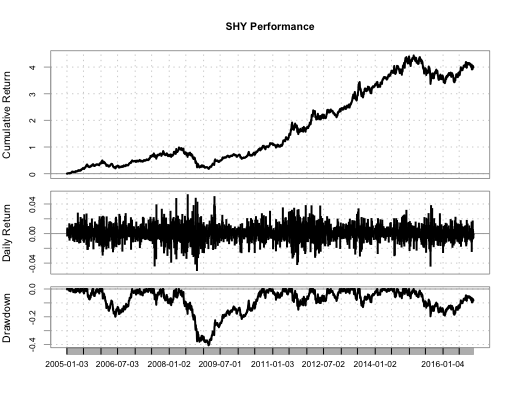

eval_rel_res = evaluate_shy_stock_relative('2330')If some stocks, instead of SHY are interested, we can do the following:

source('stock_eval.R')

evaluate_stock('2330')

evaluate_stock_pair('2330', '2357')

evaluate_stock_pair_relative('2330', '2357')Don't forget to try above yourself to see how the result is. :)

Note: have 'DEBUG=1' to show more message during computation

Visualization is always a good idea for better comprehension, especially when it is presented by a web page. Shiny is yet one perfect web visualization framework to help R programmers present their work as a web page, in less effort without downgraded outcome. A page on how SHY performs, under the whole Taiwan Stock Market, can be found at:

SHY: The 'SHarpe Yield' Strategy // SHY strategy on the whole Taiwan Stock Market

There is also a page for simple data visualization, which you can open it locally as follows:

library(shiny)

setwd("SHY_draft")

runApp()Or visit the online page: SHY_draft: Simple demonstration for data visualization

For future plan, I will present programs utilize some other R features in terms of financial analysis:

- Probability Distributions

- Linear Least Square Regression

- Confidence Intervals

- pValues

- Power of a test